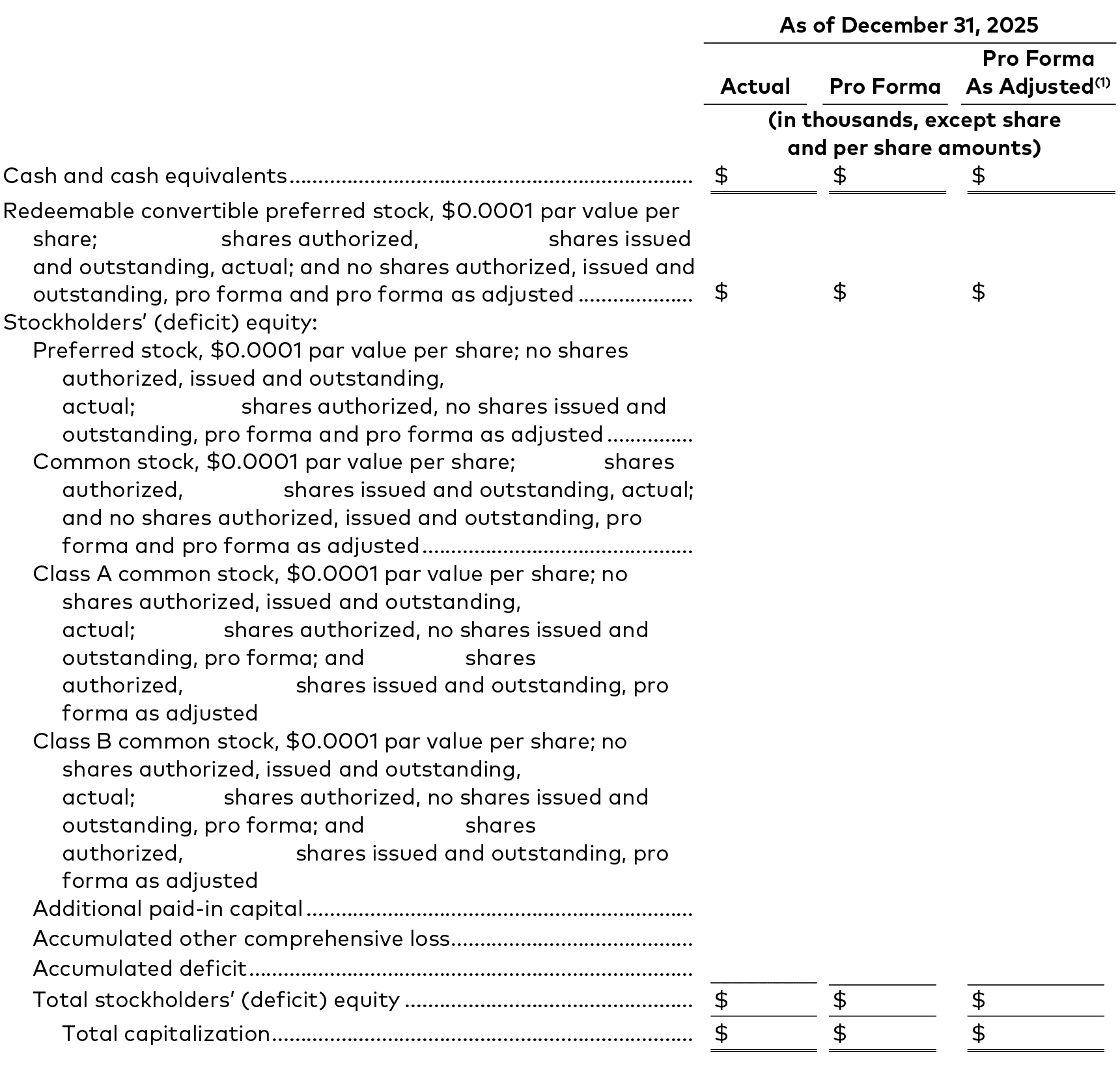

Capitalization

Section summary: This section summarizes the company’s capital structure as of the most recent balance sheet date (which could be the end of a fiscal year or quarter end) and the post-IPO capital structure. This section, at times referred to as the “cap table,” is not required by Form S-1 or Regulation S-K, but it is market practice to include. Its purpose is to provide investors with information regarding the company’s short-term and long-term liabilities and stockholders’ equity, which is helpful information for potential investors, because existing ownership claims and potential post-IPO dilution can impact an investor’s returns. The real magic here is in the “pro forma” and “pro forma as adjusted” columns, which reflect changes in connection with the IPO and changes directly resulting from the IPO, respectively. It is important to fully understand each of the capitalization restructurings, use of proceeds, etc. attendant to the offering and properly reflect them in the table.

CAPITALIZATION

The following table sets forth our cash and cash equivalents and our capitalization as of December 31, 2024:

- on an actual basis;

- on a pro forma basis, after giving effect to ;8 and

- on a pro forma as adjusted basis, after giving effect to (i) the pro forma adjustments set forth above and (ii) the issuance and sale by us of shares of Class A common stock in this offering at the assumed initial public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.9

You should read this table together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and the related notes included elsewhere in this prospectus.

(1) The pro forma as adjusted information above is illustrative only, and our capitalization following the completion of this offering will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase or decrease, as applicable, each of our pro forma as adjusted cash and cash equivalents, additional paid-in capital, total stockholders’ (deficit) equity and total capitalization by approximately $ million, assuming the number of shares of Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or decrease, as applicable, of 1.0 million shares in the number of shares of Class A common stock offered by us in this offering would increase or decrease, as applicable, each of our pro forma as adjusted cash and cash equivalents, additional paid-in capital, total stockholders’ (deficit) equity, and total capitalization by approximately $ million, assuming the assumed initial public offering price of $ per share remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

If the underwriters’ option to purchase additional shares of Class A common stock from us were exercised in full, pro forma as adjusted cash and cash equivalents, additional paid-in capital, total stockholders’ (deficit) equity, total capitalization,

14

Notes

8 This bullet should include explanatory disclosure that lays out the assumptions used to prepare pro forma information giving effect to any corporate changes that would happen at the time of the IPO (without giving effect to the IPO) on any line items, such as conversion of preferred stock and charter amendments.

9 This bullet should include explanatory disclosure that lays out the assumptions used to prepare pro forma as adjusted information giving effect to the same events discussed in the prior bullet with further adjustment for the IPO (e.g., shares issued and proceeds raised).

and shares of Class A common stock outstanding as of December 31, 2025 would be $ million, $ million, $ million, $ million, and shares, respectively.

The number of shares of our Class A common stock and Class B common stock to be outstanding after this offering is based on shares of our Class A common stock and shares of our Class B common stock outstanding as of December 31, 2025, after giving effect to the Reclassification and Exchange, and excludes:

- shares of our Class A common stock issuable upon the exercise of stock options outstanding as of December 31, 2025 under our 2018 Plan, with a weighted-average exercise price of $ per share;

- shares of our Class A common stock issuable upon the exercise of stock options granted subsequent to December 31, 2025 under our 2018 Plan, with a weighted-average exercise price of $ per share;

- shares of our Class A common stock issuable upon the vesting and settlement of restricted stock units (RSUs) outstanding as of December 31, 2025, to the extent that both the performance condition and service vesting criteria have been satisfied;

- shares of our Class A common stock reserved for future issuance under our 2026 Plan, which will become effective once the registration statement of which this prospectus forms a part is declared effective, including new shares plus the number of shares (not to exceed shares) that (i) remain available for grant of future awards under the 2019 Plan and will cease to be available for issuance under the 2019 Plan at the time our 2026 Plan becomes effective in connection with this offering, and (ii) are underlying outstanding stock awards granted under our 2019 Plan, that expire or are repurchased, forfeited, canceled or withheld, as well as any future automatic annual increases in the number of shares of Class A common stock reserved for issuance under our 2026 Plan; and

- shares of our Class A common stock reserved for issuance under our ESPP, which will become effective once the registration statement of which this prospectus forms a part is declared effective, as well as any future automatic annual increases in the number of shares of Class A common stock reserved for future issuance under our ESPP.

15

Notes

No additional comments.