Our drafting guide is built around a satirical sample Form S-1 for a fictitious company called Lazy Susan. It contains all the key context you’ll need to begin understanding the nuances of the drafting process, and we hope the dose of humor will add enjoyable momentum to your learning journey.

Cover page

Section summary: The requirements for the cover of the prospectus are set forth in Item 501 of Regulation S-K. Among other things, the cover page will set forth the number of shares being offered and the price at which they are being offered, the exchange on which the securities will be listed, and the banks that are underwriting the offering. When confidentially submitted as a draft and initially filed publicly, the Form S-1 will have blank spaces for some of the information that won’t be available until the offering is priced, after the “road show,” including the actual number of securities and final offering price. When the company launches the offering and commences its “road show,” it will file a “red herring” prospectus that must include a bona fide price range for the offering. Until the registration statement is declared effective, the “red herring” legend must be displayed on the cover page to indicate that the prospectus is subject to completion, and it will be deleted in the final prospectus.

1 The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2025

Shares

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Lazy Susan, Inc.

We are offering shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We anticipate that the initial public offering price will be between $ and $ per share. We intend to apply to list our common stock on under the symbol “SUZE.” We believe that upon the completion of this offering, we will meet the standards for listing on the [New York Stock Exchange (NYSE)/Nasdaq Global Select Market (Nasdaq)], and the closing of this offering is contingent upon such listing.

Following this offering, we will have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting, conversion and transfer rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 10 votes and is convertible at any time into one share of Class A common stock. Immediately following the completion of this offering, all outstanding shares of our Class B common stock will be beneficially owned by our founder, V. Jah Neri, who will collectively represent approximately % of the voting power of our outstanding capital stock, assuming no exercise of the underwriters’ option to purchase additional shares, and will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our Class A common stock involves risks. See the section titled “Risk Factors” beginning on page 10 to read about factors you should consider before buying our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

(1) See the section titled “Underwriting” for additional information regarding compensation payable to the underwriters.

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of our Class A common stock from us at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2025.

Prospectus dated , 2025

i

Notes

1 This language in red is the red herring disclaimer, or “subject to completion” legend, required pursuant to Item 501(b)(10) of Regulation S-K. This disclaimer is required for every registration statement filed before effectiveness, indicating that the registration statement has been filed with the Securities and Exchange Commission (SEC) but is not yet effective, is not complete and may be amended, that the securities cannot be sold until the registration statement becomes effective, and that the prospectus is not an offer to sell these securities. Once the registration statement is declared effective by the SEC, the issuer can distribute a final prospectus that contains the issuance size and pricing information and remove this disclaimer from the cover page.

Prospectus cover page

The requirements for the cover of the prospectus are set forth in Item 501 of Regulation S-K. Among other requirements, the cover lists the marketing names of all members of the underwriting syndicate. Selecting the right investment banks to serve in the underwriting syndicate is critical to ensuring successful execution of your IPO. Companies will select one or more investment banks to act as the managing bookrunners, with the lead bookrunner serving as “lead left.” All or a subset of the bookrunners will be further designated as the “Representatives” of the underwriters in the underwriting syndicate. The Representatives typically aid the company in making key decisions about the offering, including those relating to structure, timing, allocation and pricing, and will help manage the preparation of the registration statement, advise in the marketing and positioning of the company’s business, and organize any testing-the-waters communications and road show presentations. Co-managers also play a critical role in the IPO process, helping with distribution of the securities and providing post-IPO market support for the stock. The role(s) assigned to each investment bank will impact that bank’s relative allocation of the offered securities and, accordingly, its portion of the overall underwriting commission. While there are clear and legally required walls between investment bankers and analysts, it is not unusual for companies to consider the quality of the banks’ analysts in their industry and, in particular, whether those analysts will understand the company’s story and potential.

Notes

No additional comments.

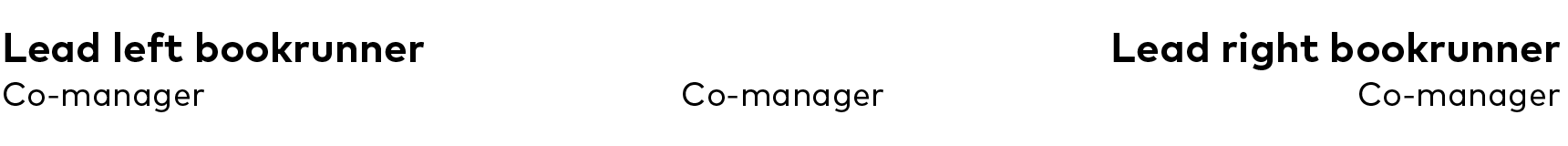

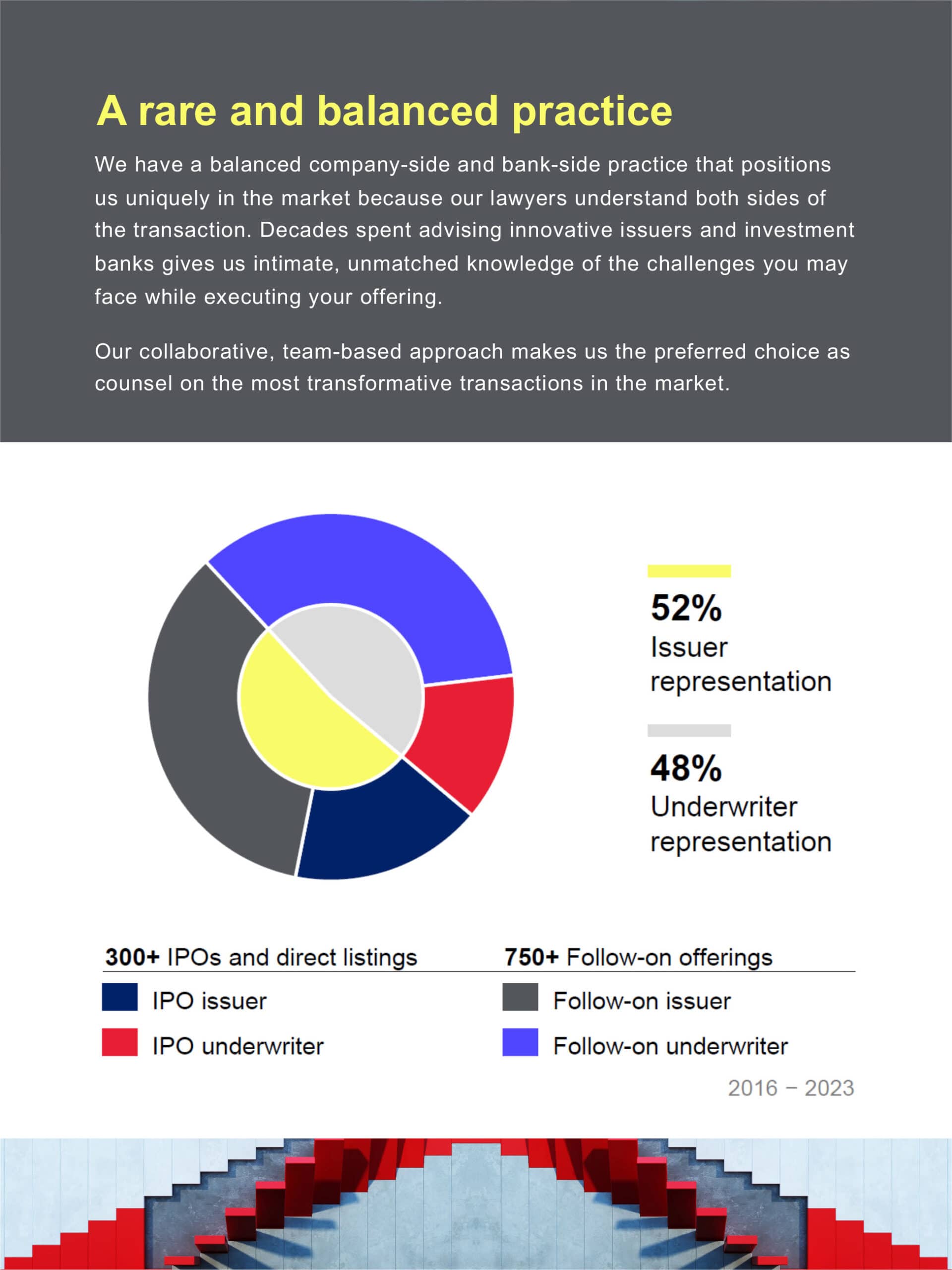

Artwork

For technology IPOs, it is common to include high-resolution “artwork” in between the prospectus cover page and the rest of the document. This typically includes some combination of product branding, key metrics and/or customer testimonials, and ties to the key business points to come later. Subject to some legalistic footnotes, this can be a wonderful place to visually captivate investors with some of the key superlatives of the business. We have instead utilized this real estate for some shameless Cooley self-promotion with our own Cooley capital markets metrics.

TABLE OF CONTENTS

PROSPECTUS

Page

Through and including , 2025 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.Neither we nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than the information contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the underwriters take responsibility for, and provide no assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Class A common stock and the distribution of this prospectus outside of the United States.

ii

Notes

No additional comments.