Dilution

Section summary: This section is required by SEC disclosure rules for all IPOs per Item 506 of Regulation S-K. The idea is to express to IPO investors how dilutive the existing cap table is on their own investment. The higher the step-up in valuation from the blended private company valuation, the higher the dilutive impact on new investors. What investors really care about is the amount of economic ownership they are getting for their investment, not the theoretical dilution from all existing stock.

DILUTION

If you invest in our Class A common stock in this offering, your interest will be diluted to the extent of the difference between the initial public offering price per share of Class A common stock and the pro forma as adjusted net tangible book value per share immediately after this offering.

As of December 31, 2024, our historical net tangible book value was $ million or $ per share. Our historical net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our common stock as of December 31, 2024.

As of December 31, 2024, our pro forma net tangible book value was $ million, or $ per share, based on the total number of shares of our common stock outstanding as of such date, after giving effect to .

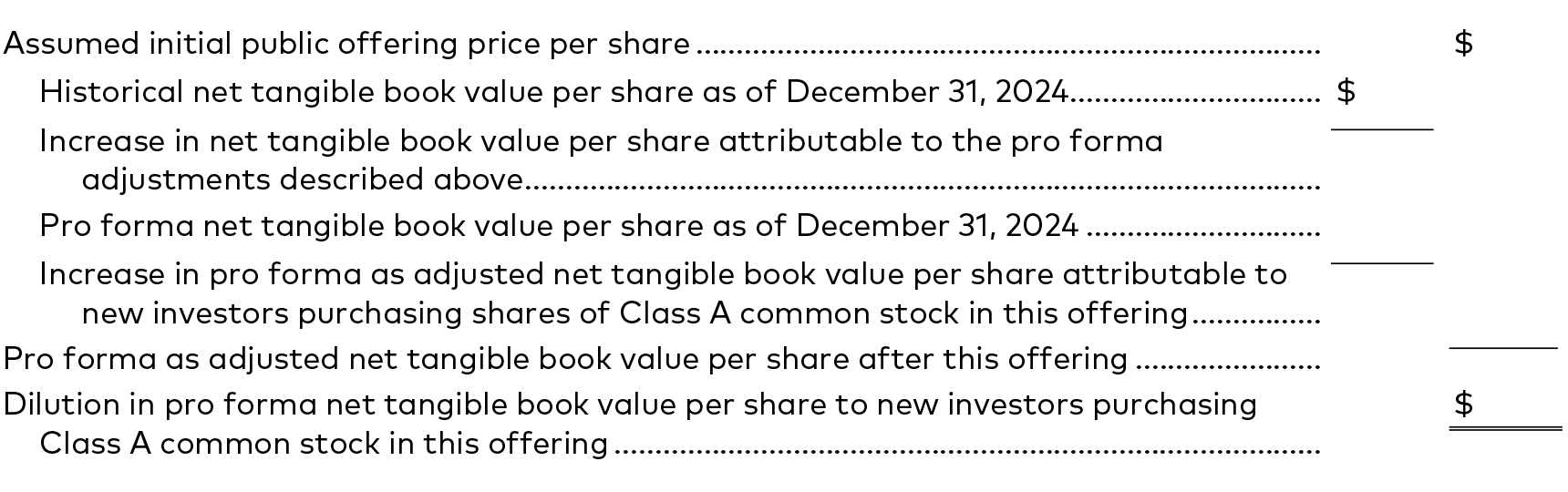

After giving effect to (i) the pro forma adjustments set forth above and (ii) the issuance and sale by us of shares of Class A common stock in this offering at the assumed initial public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of December 31, 2024 would have been approximately $ million, or $ per share of our Class A common stock. This amount represents an immediate increase in pro forma as adjusted net tangible book value of $ per share to our existing stockholders and an immediate dilution in pro forma as adjusted net tangible book value of $ per share to new investors purchasing Class A common stock in this offering. We determine dilution by subtracting the pro forma as adjusted net tangible book value per share after this offering from the initial public offering price per share paid by new investors. The following table illustrates this dilution on a per share basis:

The dilution information discussed above is illustrative only and may change based on the actual initial public offering price and other terms of this offering. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) our pro forma as adjusted net tangible book value per share after this offering by $ per share and increase (decrease) the dilution to new investors by $ per share, in each case assuming the number of shares of Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares of Class A common stock offered by us would increase (decrease) our pro forma as adjusted net tangible book value by approximately $ per share and decrease (increase) the dilution to new investors by the assumed initial public offering price of $ per share, in each case assuming the assumed initial public offering price of $ per share remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses.

If the underwriters exercise their option to purchase additional shares of our Class A common stock in full, the pro forma net tangible book value per share, as adjusted to give effect to this offering, would be $ per share, and the dilution in pro forma net tangible book value per share to investors in this offering would be $ per share.

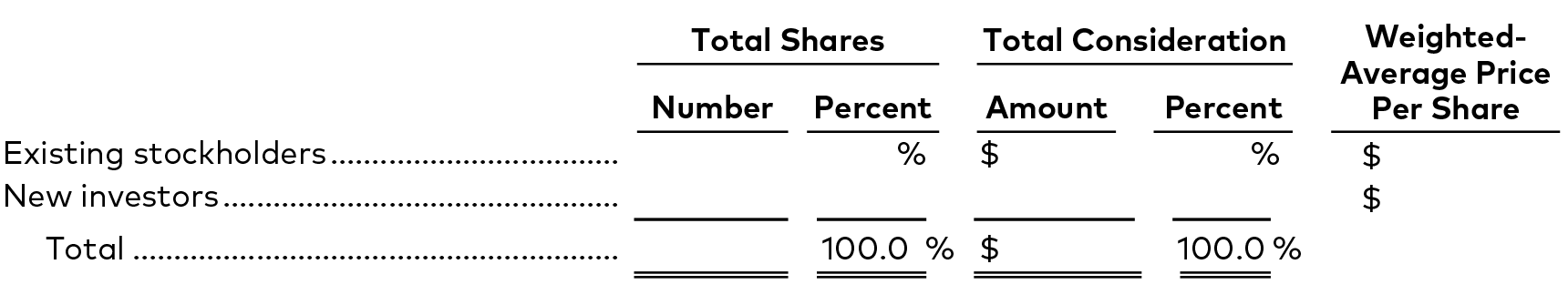

The following table summarizes, as of December 31, 2024, on a pro forma as adjusted basis, as described above, the number of shares of our Class A common stock, the total consideration, and the weighted-average price per share (i) paid to us by existing stockholders and (ii) to be paid by new investors acquiring our common stock in this offering at the assumed initial public offering price of $ per share, before deducting underwriting discounts and commissions and estimated offering expenses payable by us. As the table shows, new investors purchasing Class A common stock in this offering will pay an average price per share substantially higher than our existing stockholders paid.

16

Notes

No additional comments.

Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) the total consideration paid by new investors and total consideration paid by existing stockholders by approximately $ million, assuming that the number of shares of Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares of Class A common stock offered by us would increase (decrease) the total consideration paid by new investors and total consideration paid by existing stockholder by approximately $ million, assuming the assumed initial public offering price of $ per share remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses.

After giving effect to the sale of shares in this offering, if the underwriters exercise in full their option to purchase additional shares of our Class A common stock, the total number of shares held by new investors will increase to shares, or % of the total number of shares outstanding following the completion of this offering.

The number of shares of our Class A common stock and Class B common stock to be outstanding after this offering is based on shares of our Class A common stock and shares of our Class B common stock outstanding as of December 31, 2024, after giving effect to the Reclassification and Exchange, and excludes:10

- shares of our Class A common stock issuable upon the exercise of stock options outstanding as of December 31, 2024 under our 2018 Plan, with a weighted-average exercise price of $ per share;

- shares of our Class A common stock issuable upon the exercise of stock options granted subsequent to December 31, 2024 under our 2018 Plan, with a weighted-average exercise price of $ per share;

- shares of our Class A common stock issuable upon the vesting and settlement of restricted stock units (RSUs) outstanding as of December 31, 2024, to the extent that both the performance condition and service vesting criteria have been satisfied;

- shares of our Class A common stock reserved for future issuance under our 2025 Plan, which will become effective once the registration statement of which this prospectus forms a part is declared effective, including new shares plus the number of shares (not to exceed shares) that (i) remain available for grant of future awards under the 2018 Plan and will cease to be available for issuance under the 2018 Plan at the time our 2025 Plan becomes effective in connection with this offering, and (ii) are underlying outstanding stock awards granted under our 2018 Plan, that expire or are repurchased, forfeited, canceled or withheld, as well as any future automatic annual increases in the number of shares of Class A common stock reserved for issuance under our 2025 Plan; and

- shares of our Class A common stock reserved for issuance under our ESPP, which will become effective once the registration statement of which this prospectus forms a part is declared effective, as well as any future automatic annual increases in the number of shares of Class A common stock reserved for future issuance under our ESPP.

To the extent any outstanding options are exercised or any outstanding RSUs or RSUs that we may grant in the future vest, or we issue additional shares of common stock, new investors will experience further dilution. If all outstanding awards under our 2018 Plan as of December 31, 2024 were exercised or settled, then our existing stockholders, including the holders of these equity awards, would own % and our new investors would own % of the total number of shares of our common stock outstanding on the completion of this offering.

17

Notes

10 Exclusion bullets should be consistent with what’s included in the Box and will repeat themselves in the “Capitalization” and “Dilution” sections.