Executive Compensation

Section summary: Governed by Item 402 of Regulation S-K, this section requires disclosure of various compensation-related matters for the issuer’s executive officers. This includes a description of the compensation of the company’s named executive officers, tabular information regarding the named executive officers’ compensation paid, grants of plan-based awards, outstanding equity awards, options exercised and stock vested, pension benefits, and nonqualified deferred compensation, termination and severance provisions. This section also requires a director compensation table. Companies that are not smaller reporting companies or emerging growth companies must also provide a Compensation Discussion and Analysis.

Smaller reporting companies and emerging growth companies (EGCs) are afforded certain accommodations that permit them to provide scaled disclosure related to executive compensation. See the “Cooley color” below for more details on the scaled reporting requirements for EGCs.

EXECUTIVE COMPENSATION

Our named executive officers for the year ended December 31, 2025, consisting of our principal executive officer and the next two most highly compensated executive officers, were:

- V. Jah Neri, Chief Executive Officer;

- Moe Neeman, Chief Financial Officer; and

- Rhoda Maps, Chief Operating Officer.

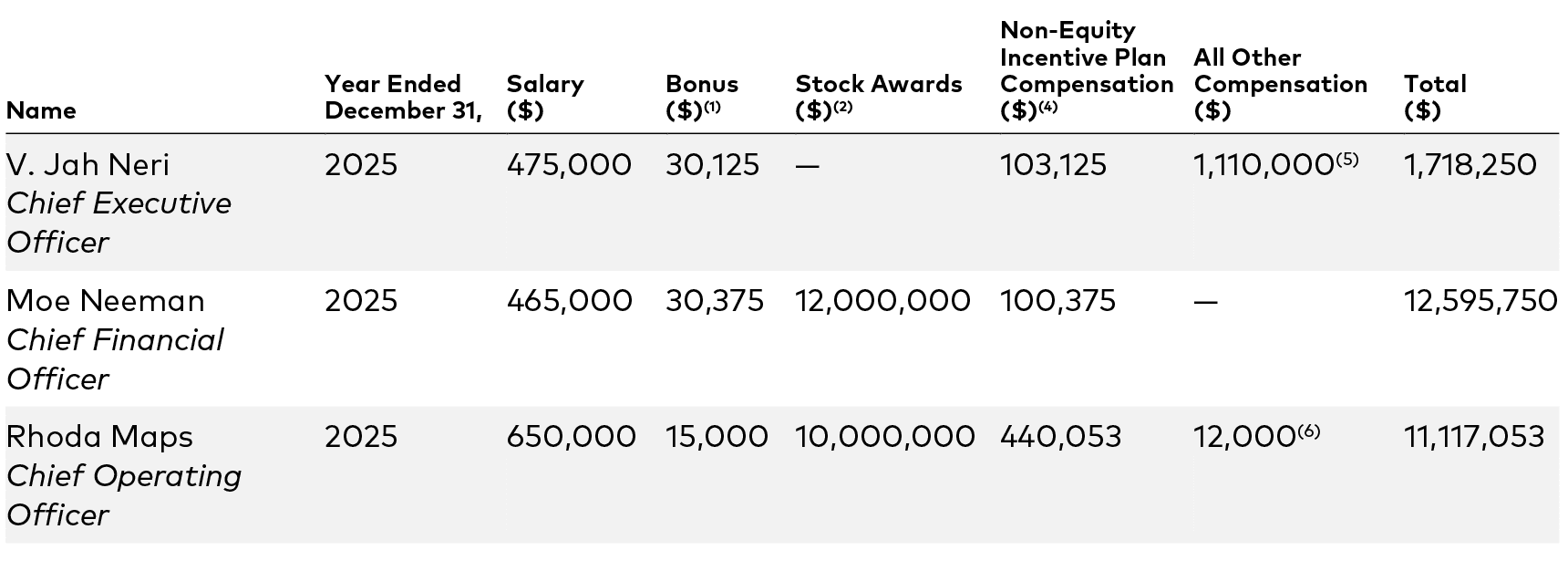

The following table presents all of the compensation awarded to, earned by, or paid to our named executive officers during the year ended December 31, 2025.

(1) Amounts reported represent discretionary cash bonuses paid to the named executive officers as a special one-time award. These special bonuses were paid to all eligible Lazy Susan employees to show our appreciation for their efforts during the year ended the year ended December 31, 2025.

(2) Amounts reported represent the aggregate grant date fair value of stock awards granted to our executive officers during 2025, under our 2019 Plan computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation, or ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions used in calculating the grant date fair value of the stock awards reported in these columns are set forth in the notes to our audited consolidated financial statements included elsewhere in this prospectus. These amounts will not reflect the actual economic value that may be realized by the named executive officers.

(3) Amounts reported in this column represent total cash bonuses earned by the named executive officers based on achievement of corporate performance goals as determined by our compensation committee for the year ended December 31, 2025.

(4) Amounts reported in this column represent total cash bonuses earned during the year ended December 31, 2025 based on achievement of corporate performance goals as determined by our compensation committee. See the section titled “—Annual Performance-Based Bonus Opportunity” below for additional information.

(5) Reflects (a) contributions paid by us at the direction of Mr. Jah Neri to a not-for-profit entity on which Mr. Jah Neri serves on the board of directors, (b) legal fees we have paid or intend to pay on behalf of Mr. Jah Neri for the review of his grant agreements, (c) personal security for Mr. Jah Neri, (d) incremental costs for personal use of Company aircraft by Mr. Jah Neri, and (e) incremental costs attributable to the total catering costs incurred when family members and guests of Mr. Jah Neri occasionally accompany him on business travel on Company aircraft.

(6) Reflects $12,000 in travel expenses to our All Star’s Club trip for Ms. Maps’ husband paid by us on behalf of Ms. Maps.

33

Notes

No additional comments.

Scaled compensation disclosure for EGCs

Like Lazy Susan, emerging growth companies (EGCs), as defined in the Jumpstart Our Business Startups (JOBS) Act, are permitted to include less extensive narrative disclosure than required of other reporting companies, particularly in the description of executive compensation. Once the company ceases to be an EGC, far more detailed disclosure, including a full compensation discussion and analysis (CD&A), for a larger group of the company’s executives will be required. There will also be additional requirements, such as nonbinding advisory votes (i.e., say-on-pay votes) in connection with annual shareholder meetings.

Benefits and perquisites for NEOs

It is critical to identify and disclose all personal benefits and perquisites (perks) for the named executive officers (NEOs) in this table, and the nature and level of disclosure depends on specific materiality thresholds set forth in Item 402 of Regulation S-K. In footnotes 5 and 6, we have included a few examples not uncommon for founders, but there can be many others where the company spends money for services (or reimburses expenses) that accrue to the benefit of the NEO. Aircraft travel can be a particularly complex area where, in many cases, NEOs use an aircraft (often owned or leased by the founder) for a combination of business and personal purposes, and the determination of what constitutes a perk and requires disclosure for compensation purposes necessitates close analysis. Note also that while all companies are required to identify perks to the NEO included in the above disclosure, EGCs are not required to include the specific amounts.

If the amounts in footnotes 5 and 6 include tax gross-ups, those should be delineated separately and the amounts provided (if material) or additional disclosure provided of the nature of the gross-up (if immaterial).

Annual Performance-Based Bonus Opportunity ![]()

In addition to base salaries, our named executive officers are eligible to receive performance-based cash bonuses, which are designed to provide appropriate incentives to our executives to achieve defined performance goals and to reward our executives for individual achievement towards these goals. The performance-based bonus each executive officer is eligible to receive is generally based on the extent to which we achieve the corporate goals that our board of directors or compensation committee establishes.

For the year ended December 31, 2025, Messrs. Jah Neri and Neeman and Ms. Maps were each eligible to receive a bonus at an annual target of 50%, 50%, and 100%, respectively, of their base salaries. Our corporate performance objectives for the year ended December 31, 2025 related to achievement of certain financial metrics. In July 2025, upon the recommendation of our compensation committee, our board of directors approved an increase to Mr. Jah Neri’s annual bonus target to 100% of his base salary, effective July 1, 2025.

Equity-Based Incentive Awards

Our equity award program is the primary vehicle for offering long-term incentives to our executives. We believe that equity awards provide our executives with a strong link to our long-term performance, create an ownership culture, and help to align the interests of our executives and our stockholders. We further believe that our equity awards are an important retention tool for our executives as well as for our other employees.

Historically, we have granted RSU awards and stock option awards subject to service-based, performance-based, and/or market-based conditions. Grants to our executives and other employees are made at the discretion of our compensation committee and are not made at any specific time period during a year. Prior to this offering, all of the equity awards we granted were made pursuant to our 2019 Plan, the terms of which are described below under “—Employee Benefit and Stock Plans.” The terms of equity awards granted to our named executive officers in the year ended December 31, 2025 are described below under “—Outstanding Equity Awards as of December 31, 2025.”

34

Notes

No additional comments.

Annual performance targets

How much disclosure to provide related to annual performance targets here will vary depending on the company, its philosophy, and compensatory goals and materiality determinations. Typically, however, for an EGC there is a high-level description of the nature of the financial metric (e.g., revenue or EBITDA) used for the performance goal without disclosure of the quantification of the actual metric for the particular year in question (similar to the level of disclosure under Item 5.02 of Form 8-K). It is a common practice for companies going public to adopt an omnibus cash incentive plan at IPO that provides a menu of potential performance measures and a general description of the bonus plan, which may then allow the company to avoid subsequent Item 5.02 8-Ks for the future setting of bonus targets and payouts consistent with that disclosed plan. It is important that investors understand the alignment between executive compensation and broader company objectives, but companies are (rightfully) sensitive to putting out annual target goals to investors, which targets may not exactly align with street guidance or analyst/investor expectations and could create confusion.

Mr. Jah Neri

On July 3, 2024, after carefully considering market data and recommendations from our independent compensation consultant, our board of directors approved the grant of a stock option under our 2019 Plan to Mr. Jah Neri to purchase up to 9,000,000 shares of Class B common stock, contingent and effective upon a listing event, which includes this offering. This award was approved in recognition of Mr. Jah Neri’s instrumental role in achieving our strategic and business goals to date and, more importantly, the significant potential impact of his role on an ongoing basis. This award is designed to provide both multi-year retention incentives for Mr. Jah Neri and to align achievement of business and operating objectives with long-term stockholder value creation. Our board of directors believes that achievement of the Target Stock Values described below would result in significant value for our stockholders over the performance period.

Mr. Jah Neri’s option is divided into 10 tranches that may be earned as specified in the table below, subject to both (1) a service-based condition and (2) our achievement of Target Stock Value prior to the applicable Option Valuation Expiration Date. “Target Stock Value” with respect to Mr. Jah Neri’s award is based on the percentage of the price per share at which shares of our Class A common stock are first sold to the public in connection with this offering, or the IPO Price, except as described below in the event of a “sale event.”

For purposes of the option, the Target Stock Value will be achieved, following a listing event, on the date when the volume weighted-average price per share of our Class A common stock during a period of 90 consecutive trading days equals or exceeds the applicable Target Stock Value. The exercise price per share of the option will be the IPO Price. Each tranche of the option will vest on the first date following satisfaction of both the service-based condition and the Target Stock Value subject to Mr. Jah Neri’s continued service with us as our full-time Chief Executive Officer through such date. The shares underlying each tranche will satisfy the service-based condition in 20 equal quarterly installments (rounding down to the nearest whole share, except for the last vesting installment), beginning on January 26, 2025. Each unvested tranche of the option will expire and be forfeited if the Target Stock Value is not achieved on or before the Option Valuation Expiration Date noted in the table above, and each vested tranche will expire and be forfeited on the tenth anniversary of the grant date.

If a Sale Event (as defined in our 2019 Plan) occurs following a listing event, the fair market value of a share will be calculated as of the consummation of such sale event with reference to the consideration payable to the holder of one share in connection with such sale event (with linear interpolation if the common stock value falls between two target stock values). If the Target Stock Value is met as of such sale event, the option will continue to vest subject to Mr. Jah Neri’s continued performance of services and be subject to any “double-trigger” acceleration provisions provided in any written employment agreement, offer letter or other agreement or arrangement between us and Mr. Jah Neri, unless otherwise provided. If the stock valuation condition is met as of such sale event and this option is not assumed or continued or substituted for by the successor entity, the option will be deemed to have met the service-based condition effective as of immediately prior to the sale event. To the extent any portion of the option does not meet the Target Stock Value as of the sale event (and is not otherwise vested and exercisable), such portion will terminate in its entirety, unless otherwise provided.

If Mr. Jah Neri’s continued service with us as our full-time Chief Executive Officer is terminated by us without cause, as a result of Mr. Jah Neri’s resignation for good reason, or due to Mr. Jah Neri’s death or disability after achieving the applicable Target Stock Value, such portion of the option will be deemed to have met the service-based condition and be fully vested and exercisable as of the date of termination. Shares acquired upon exercise of the option must be held by Mr. Jah Neri for at least 12 months while he continues to have a service relationship (as defined in our 2019 Plan) with us, unless otherwise provided.

The actual grant date fair value associated with the option will be determined upon the closing of this offering.

35

Notes

No additional comments.

Mr. Neeman

In March 2025, our compensation committee granted an RSU award in respect of 650,000 shares of our Class B common stock to Mr. Neeman. The RSU award vests upon satisfaction of both a service-based condition and a performance-based condition. The service-based condition is satisfied in four annual installments beginning April 15, 2026 through April 15, 2029 in respect of 75,000, 125,000, 150,000, and 300,000 shares, respectively, subject to continued service with us as of each such date. The performance-based condition will be satisfied in connection with this offering.

Ms. Maps

In March 2025, our compensation committee granted an RSU award in respect of 525,000 shares of our Class B common stock to Ms. Maps. The RSU award vests upon satisfaction of both a service-based condition and a performance-based condition. The service-based condition is satisfied in four annual installments beginning April 15, 2026 through April 15, 2029 in respect of 50,000, 100,000, 125,000, and 250,000 shares, respectively, subject to continued service with us as of each such date. The performance-based condition will be satisfied in connection with this offering.

Agreements with Our Named Executive Officers

We have entered into confirmatory offer letters with each of our named executive officers, which provide for an annual base salary, target annual bonus opportunity, severance benefits pursuant to our Severance Plan (described below under “—Potential Payments upon Termination or Change in Control”) and standard employee benefits generally available to our employees. We have entered into an Employee Confidential Information and Inventions Assignment Agreement with each of our named executive officers. Each of our named executive officers is employed at-will.

Potential Payments upon Termination or Change in Control

Each of our named executive officers is eligible to receive benefits under the terms of our Severance and Change in Control Plan, or the Severance Plan, which was approved on March 1, 2025. The Severance Plan provides for severance benefits to the named executive officers upon a “change in control termination” (as described below). Upon a change in control termination, each of our named executive officers is entitled to a lump sum payment equal to a portion of his base salary (18 months for Mr. Jah Neri and 12 months for each of Mr. Neeman and Ms. Maps), a lump sum payment equal to 100% of his annual target cash bonus, payment of COBRA premiums for up to 12 months and accelerated vesting of outstanding time-vesting equity awards. To the extent an equity award is not assumed, continued or substituted for in the event of certain change in control transactions and the executive’s employment is not terminated as of immediately prior to such change in control, the vesting of such equity award will also accelerate in full (and for equity awards subject to performance vesting, performance will be deemed to be achieved at target, unless otherwise provided in individual award documents). All severance benefits under the Severance Plan are subject to the executive’s execution of an effective release of claims against us.

For purposes of the Severance Plan, a “change in control termination” is an involuntary termination without “cause” (and not as a result of death or disability) or a resignation for “good reason” (each as defined in the Severance Plan), in any case that occurs during the period of time beginning three months prior to, and ending 12 months following, a “change in control,” as defined in the Severance Plan, or the “change in control period.”

Each of our named executive officers’ equity awards is further subject to the terms of our 2019 Plan and the applicable award agreement thereunder. A description of the termination and change in control provisions in our 2019 Plan and awards granted thereunder is provided below under “—Employee Benefit and Stock Plans,” and a description of the vesting provisions of each equity award held by our named executive officers which is outstanding and unvested as of December 31, 2025 is provided below under “—Outstanding Equity Awards as of December 31, 2025.” A description of the option to be granted to Mr. Jah Neri in connection with and contingent upon this offering is provided above under “—Equity-Based Incentive Awards.”

36

Notes

No additional comments.

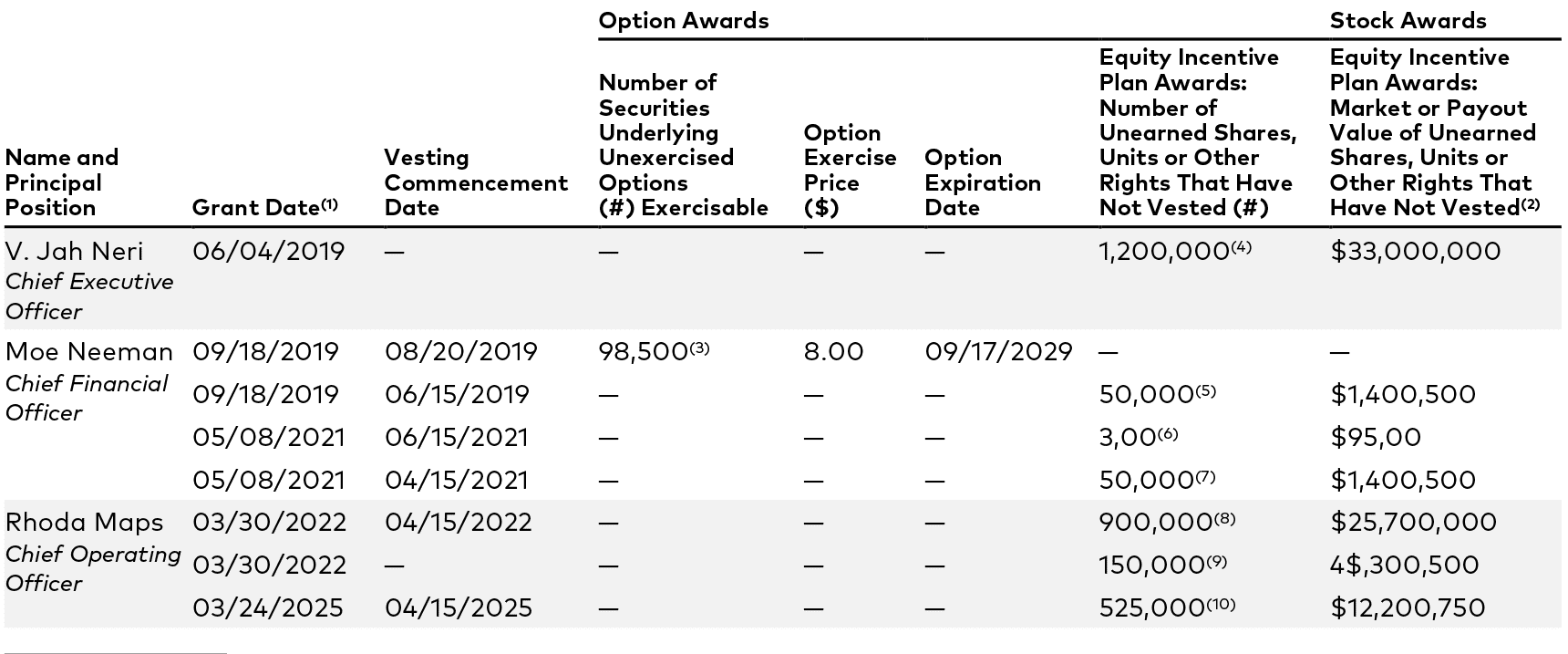

Outstanding Equity Awards as of December 31, 2025

The following table presents the outstanding equity awards held by each named executive officer as of December 31, 2025.

(6) The RSUs vest on the first date upon which both a service-based condition and a performance-based condition are satisfied. The service-based condition is satisfied as to 50% of the RSUs on the six-month anniversary of the vesting commencement date, and the remaining RSUs vest in two equal quarterly installments thereafter, subject to the named executive officer’s continued service to us through each applicable vesting date. The performance-based condition will be satisfied in connection with this offering.

(7) The RSUs vest on the first date upon which both a service-based condition and a performance-based condition are satisfied. The service-based condition is satisfied in 16 equal quarterly installments, measured from April 15, 2020, subject to the named executive officer’s continued service to us through each applicable vesting date. The performance-based condition will be satisfied in connection with this offering.

(8) The RSUs vest on the first date upon which both a service-based condition and a performance-based condition are satisfied. The service-based condition is satisfied as to 25% of the RSUs on the first anniversary of the vesting commencement date, and the remaining RSUs vest in 12 equal quarterly installments thereafter, subject to the named executive officer’s continued service to us through each applicable vesting date. The performance-based condition will be satisfied in connection with this offering.

(9) The PSUs granted to Ms. Maps will vest if a stock price hurdle of $100 per share is achieved by March 30, 2028, subject to Ms. Maps’ continued service to us through the achievement date. The stock price hurdle is based on the average closing stock price of our Class A common stock over 45 consecutive trading days following expiration of the lock-up period relating to this offering.

(10) The RSUs vest on the first date upon which both a service-based condition and a performance-based condition are satisfied. The service-based condition is satisfied in four annual installments, measured from April 15, 2024, in respect of 50,000, 100,000, 125,000, and 250,000 shares, respectively, subject to the named executive officer’s continued service to us through each applicable vesting date. The performance-based condition will be satisfied in connection with this offering.

37

Notes

No additional comments.

Emerging Growth Company Status

We are an emerging growth company, as defined in the JOBS Act. As an emerging growth company, we will be exempt from certain requirements related to executive compensation, including, but not limited to, the requirements to hold a nonbinding advisory vote on executive compensation and to provide information relating to the ratio of total compensation of our Chief Executive Officer to the median of the annual total compensation of all of our employees, each as required by the Investor Protection and Securities Reform Act of 2010, which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Other Compensation and Benefits

All of our current named executive officers are eligible to participate in our employee benefit plans, including our medical, dental, vision, life, disability, and accidental death and dismemberment insurance plans, in each case, on the same basis as all of our other employees. We pay the premiums for the life, disability, and accidental death and dismemberment insurance for all of our employees, including our named executive officers. We also provide a cell phone allowance to all of our employees, including our named executive officers other than Mr. Jah Neri. Other than such broad-based benefits and our 401(k) plan as described below, we generally do not provide perquisites or personal benefits to our named executive officers.

Our named executive officers did not participate in, or earn any benefits under, any pension or nonqualified deferred compensation plan sponsored by us during December 31, 2024. Our board of directors may elect to provide our officers and other employees with nonqualified defined contribution or other nonqualified deferred compensation benefits in the future if it determines that doing so is in our best interests.

Employee 401(k) Plan

We maintain a 401(k) plan that provides eligible U.S. employees with an opportunity to save for retirement on a tax advantaged basis. Eligible employees are able to make pre-tax and after-tax contributions of eligible compensation up to certain Code limits, which are updated annually. We have the ability to make matching and discretionary contributions to the 401(k) plan. Currently, we do not make matching contributions or discretionary contributions to the 401(k) plan. The 401(k) plan is intended to be qualified under Section 401(a) Internal Revenue Code of 1986, as amended, or the Code, with the related trust intended to be tax exempt under Section 501(a) of the Code. As a tax-qualified retirement plan, contributions to the 401(k) plan are deductible by us when made and pre-tax contributions and earnings on pre-tax and after-tax contributions are not generally taxable to the employees until withdrawn or distributed from the 401(k) plan.

38

Notes

No additional comments.

Employee Benefit and Stock Plans

2026 Equity Incentive Plan

Our board of directors intends to adopt, and we will seek stockholder approval of, the 2026 Plan. Our 2026 Plan is a successor to and continuation of our 2019 Plan and will become effective at the time of execution of the underwriting agreement related to this offering. Our 2026 Plan will come into existence upon its adoption by our board of directors and no grants will be made under our 2026 Plan prior to its effectiveness. Once our 2026 Plan becomes effective, no further grants will be made under our 2019 Plan.

Types of Awards. Our 2026 Plan provides for the grant of incentive stock options (ISOs), within the meaning of Section 422 of the Code, to our employees and our parent and subsidiary corporations’ employees, if applicable, and for the grant of nonstatutory stock options (NSOs), stock appreciation rights, restricted stock awards, RSU awards, performance-based awards and other awards, or collectively, awards. ISOs may be granted only to our employees, including our officers, and the employees of our affiliates. All other awards may be granted to our employees, including our officers, our non-employee directors and consultants and the employees and consultants of our affiliates.

Authorized Shares. The maximum number of shares of Class A common stock that may be issued under our 2026 Plan is shares, which is the sum of: (1) new shares, plus (2) an additional number of shares not to exceed , consisting of (A) shares that remain available for the issuance of awards under our 2018 Plan as of immediately prior to the time our 2026 Plan becomes effective and (B) shares of our common stock subject to outstanding awards granted under our 2018 Plan that, on or after the effective date of our 2026 Plan, terminate or expire prior to exercise or settlement; are not issued because the award is settled in cash; are forfeited because of the failure to vest; or are reacquired or withheld (or not issued) to satisfy a tax withholding obligation or the purchase or exercise price, if any, as such shares become available from time to time. The number of shares of Class A common stock reserved for issuance under our 2026 Plan will automatically increase on January 1 of each fiscal year, beginning on January 1, 2027, and continuing through and including January 1, 2036, by five percent (5%) of the aggregate number of shares of common stock of all classes issued and outstanding on December 31 of the preceding fiscal year, or a lesser number of shares determined by our board of directors prior to the applicable January 1. The maximum number of shares of Class A common stock that may be issued upon the exercise of ISOs under our 2026 Plan is shares.

Shares issued under our 2026 Plan will be authorized but unissued or reacquired shares of Class A common stock. Shares subject to awards granted under our 2026 Plan that expire or terminate without being exercised in full, or that are paid out in cash rather than in shares, will not reduce the number of shares available for issuance under our 2026 Plan. Additionally, shares issued pursuant to awards under our 2026 Plan that we repurchase or that are forfeited, as well as shares used to pay the exercise price of an award or to satisfy the tax withholding obligations to an award, will become available for future grant under our 2026 Plan.

The maximum number of shares of Class A common stock subject to stock awards granted under the 2026 Plan or otherwise during any fiscal year that begins following execution of the underwriting agreement for this offering to any non-employee director, taken together with any cash fees paid by us to such non-employee director during such fiscal year for service on the board of directors, will not exceed $[750,000] in total value (calculating the value of any such stock awards based on the grant date fair value of such stock awards for financial reporting purposes), or, with respect to the fiscal year in which a non-employee director is first appointed or elected to our board of directors, $[1,500,000].

Plan Administration. Our board of directors, or a duly authorized committee of our board of directors, will administer our 2026 Plan and is referred to as the “administrator.” The administrator may also delegate to one or more persons or bodies the authority to do one or more of the following: (1) designate recipients (other than officers) to receive specified awards provided that no person or body may be delegated authority to grant an award to themselves; (2) determine the number of shares subject to such awards; and (3) determine the terms of such awards. The administrator has the authority to determine the terms of awards, including recipients, the exercise, purchase, or strike price of awards, if any, the number of shares subject to each award, the fair market value of a share of Class A common stock, the vesting schedule applicable to the awards, together with any vesting acceleration, and the form of consideration, if any, payable upon exercise or settlement of the awards and the terms of the award agreements for use under our 2026 Plan.

39

Notes

No additional comments.

In addition, subject to the terms of the 2025 Plan, the administrator also has the power to modify outstanding awards under our 2025 Plan, including the authority to reprice any outstanding option or stock appreciation right, cancel and re-grant any outstanding option or stock appreciation right in exchange for new stock awards, cash, or other consideration, or take any other action that is treated as a repricing under GAAP, with the consent of any materially adversely affected participant.

Stock Options. ISOs and NSOs are granted pursuant to stock option agreements adopted by the administrator. The administrator determines the exercise price for a stock option, within the terms and conditions of the 2025 Plan, provided that the exercise price of a stock option generally cannot be less than 100% of the fair market value of our Class A common stock on the date of grant. Options granted under the 2025 Plan vest at the rate specified in the stock option agreement as determined by the administrator.

The administrator determines the term of stock options granted under the 2025 Plan, up to a maximum of 10 years. Unless the terms of an optionholder’s stock option agreement provide otherwise, if an optionholder’s service relationship with us, or any of our affiliates, ceases for any reason other than disability, death, or cause, the optionholder may generally exercise any vested options for a period of three months following the cessation of service. The option term may be extended in the event that either an exercise of the option or an immediate sale of shares acquired upon exercise of the option following such a termination of service is prohibited by applicable securities laws or our insider trading policy. If an optionholder’s service relationship with us or any of our affiliates ceases due to disability or death, or an optionholder dies within a certain period following cessation of service, the optionholder or a beneficiary may generally exercise any vested options for a period of 12 months in the event of death or disability. In the event of a termination for cause, options generally terminate immediately upon the termination of the individual for cause. In no event may an option be exercised beyond the expiration of its term.

Acceptable consideration for the purchase of Class A common stock issued upon the exercise of a stock option will be determined by the administrator and may include (1) cash, check, bank draft, or money order, (2) a broker-assisted cashless exercise, (3) the tender of shares of Class A common stock previously owned by the optionholder, (4) a net exercise of the option if it is an NSO, and (5) other legal consideration approved by the administrator. Options may not be transferred to third-party financial institutions for value. Unless the administrator provides otherwise, options generally are not transferable except by will, the laws of descent, and distribution or pursuant to a domestic relations order. An optionholder may designate a beneficiary who may exercise the option following the optionholder’s death.

Restricted Stock Awards. Restricted stock awards are granted pursuant to restricted stock award agreements adopted by the administrator. The administrator determines the consideration, if any, payable for restricted stock awards, which may include, but is not limited to, cash, check, bank draft, or money order. Class A common stock acquired under a restricted stock award may, but need not, be subject to a share repurchase option in our favor in accordance with a vesting schedule to be determined by the administrator. A restricted stock award may be transferred only upon such terms and conditions as set by the administrator. Except as otherwise provided in the applicable award agreement, restricted stock awards that have not vested may be forfeited or repurchased by us upon the participant’s cessation of continuous service for any reason.

Restricted Stock Unit Awards. RSU awards are granted pursuant to RSU award agreements adopted by the administrator. The administrator determines the consideration, if any, payable for RSU awards, which may include, but is not limited to, cash, check, bank draft, or money order. A RSU award may be settled by cash, delivery of stock, or a combination of cash and stock as deemed appropriate by the administrator or in any other form of consideration set forth in the RSU award agreement. Additionally, dividend equivalents may be credited in respect of shares covered by a RSU award. Except as otherwise provided in the applicable award agreement, RSUs that have not vested will be forfeited upon the participant’s cessation of continuous service for any reason.

Stock Appreciation Rights. Stock appreciation rights are granted pursuant to stock appreciation right grant agreements adopted by the administrator. The administrator determines the strike price for a stock appreciation right, which generally cannot be less than 100% of the fair market value of Class A common stock on the date of grant. Upon the exercise of a stock appreciation right, we will pay the participant an amount equal to the product of (1) the excess of the per share fair market value of Class A common stock on the date of exercise over the strike price, multiplied by (2) the number of shares of Class A common stock with respect to which the stock appreciation right is exercised. A stock appreciation right granted under the 2025 Plan vests at the rate specified in the stock appreciation right agreement as determined by the administrator.

40

Notes

No additional comments.

The administrator determines the term of stock appreciation rights granted under the 2026 Plan, up to a maximum of 10 years. Unless the terms of a participant’s stock appreciation right agreement provide otherwise, if a participant’s service relationship with us or any of our affiliates ceases for any reason other than disability, death, or cause, the participant may generally exercise any vested stock appreciation righ3t for a period of three months following the cessation of service. The stock appreciation right term may be further extended in the event that exercise of the stock appreciation right following such a termination of service is prohibited by applicable securities laws. If a participant’s service relationship with us, or any of our affiliates, ceases due to disability or death, or a participant dies within a certain period following cessation of service, the participant or a beneficiary may generally exercise any vested stock appreciation right for a period of 12 months in the event of death or disability. In the event of a termination for cause, stock appreciation rights generally terminate immediately upon the occurrence of the event giving rise to the termination of the individual for cause. In no event may a stock appreciation right be exercised beyond the expiration of its term.

Performance Awards. Our 2026 Plan permits the grant of performance-based stock and cash awards. The administrator can structure such awards so that the stock or cash will be issued or paid pursuant to such award only following the achievement of certain preestablished performance goals during a designated performance period. Performance awards that are settled in cash or other property are not required to be valued in whole or in part by reference to, or otherwise based on, our Class A common stock.

The performance criteria that will be used to establish such performance goals may be based on any one of, or combination of, the following as determined by the administrator: earnings (including earnings per share and net earnings); earnings before interest, taxes and depreciation; earnings before interest, taxes, depreciation and amortization; total stockholder return; relative stockholder return; return on equity or average stockholder’s equity; return on assets, investment, or capital employed; stock price; margin (including gross margin); income (before or after taxes); operating income; operating income after taxes; pre-tax profit; operating cash flow; sales, annual recurring revenue or revenue targets; increases in revenue or product revenue; expenses and cost reduction goals; improvement in or attainment of working capital levels; economic value added (or an equivalent metric); market share; cash flow; cash flow per share; share price performance; debt reduction; customer satisfaction; stockholders’ equity; capital expenditures; debt levels; operating profit or net operating profit; growth of net income or operating income; billings; financing; regulatory milestones; stockholder liquidity; corporate governance and compliance; intellectual property; personnel matters; progress of internal research; progress of partnered programs; partner satisfaction; budget management; partner or collaborator achievements; internal controls, including those related to the Sarbanes-Oxley Act; investor relations, analysts, and communication; implementation or completion of projects or processes; employee retention; number of users, including unique users; strategic partnerships or transactions (including in-licensing and out-licensing of intellectual property); establishing relationships with respect to the marketing, distribution and sale of our products; supply chain achievements; co-development, co-marketing, profit sharing, joint venture or other similar arrangements; individual performance goals; corporate development and planning goals; and any other measure of performance selected by the administrator.

The administrator may establish performance goals on a company-wide basis, with respect to one or more business units, divisions, affiliates, or business segments, and in either absolute terms or relative to the performance of one or more comparable companies or the performance of one or more relevant indices. Unless specified otherwise in the award agreement at the time the award is granted or in such other document setting forth the performance goals at the time the goals are established, the administrator will appropriately make adjustments in the method of calculating the attainment of the performance goals as follows: (1) to exclude restructuring and/or other nonrecurring charges; (2) to exclude exchange rate effects; (3) to exclude the effects of changes to GAAP; (4) to exclude the effects of any statutory adjustments to corporate tax rates; (5) to exclude the effects of items that are “unusual” in nature or occur “infrequently” as determined under GAAP; (6) to exclude the dilutive effects of acquisitions or joint ventures; (7) to assume that any business divested by us achieved performance objectives at targeted levels during the balance of a performance period following such divestiture; (8) to exclude the effect of any change in the outstanding shares of Class A or Class B common stock by reason of any stock dividend or split, stock repurchase, reorganization, recapitalization, merger, consolidation, spin-off, combination, or exchange of shares or other similar corporate change, or any distributions to common stockholders other than regular cash dividends; (9) to exclude the effects of stock-based compensation and the award of bonuses under our bonus plans; (10) to exclude costs incurred in connection with potential acquisitions or divestitures that are required to be expensed under GAAP; and (11) to exclude the goodwill and intangible asset impairment charges that are required to be recorded under GAAP.

41

Notes

No additional comments.

Other Awards. The administrator may grant other awards based in whole or in part by reference to Class A common stock. The administrator will set the number of shares under the award and all other terms and conditions of such awards.

Changes to Capital Structure. In the event there is a change in our capital structure, such as a stock split, reverse stock split or recapitalization, appropriate adjustments will be made to (1) the class and maximum number of shares reserved for issuance under the 2026 Plan, (2) the class and maximum number of shares by which the share reserve may increase automatically each year, (3) the class and maximum number of shares that may be issued upon the exercise of ISOs, and (4) the class, number of shares, and exercise price, strike price, or purchase price, if applicable, of all outstanding awards.

Corporate Transactions. In the event of a corporate transaction, any stock awards outstanding under the 2026 Plan may be assumed, continued, or substituted for by any surviving or acquiring corporation (or its parent company), and any reacquisition or repurchase rights held by us with respect to the stock award may be assigned to the successor (or its parent company). If the surviving or acquiring corporation (or its parent company) does not assume, continue or substitute for such stock awards, then (i) with respect to any such stock awards that are held by participants whose continuous service has not terminated prior to the effective time of the corporate transaction, or current participants, the vesting (and exercisability, if applicable) of such stock awards will be accelerated in full to a date prior to the effective time of the corporate transaction (contingent upon the effectiveness of the corporate transaction), and such stock awards will terminate if not exercised (if applicable) at or prior to the effective time of the corporate transaction, and any reacquisition or repurchase rights held by us with respect to such stock awards will lapse (contingent upon the effectiveness of the corporate transaction), and (ii) any such stock awards that are held by persons other than current participants will terminate if not exercised (if applicable) prior to the effective time of the corporate transaction, except that any reacquisition or repurchase rights held by us with respect to such stock awards will not terminate and may continue to be exercised notwithstanding the corporate transaction.

In addition, the administrator may also provide, in its sole discretion, that the holder of a stock award that will terminate upon the occurrence of a corporate transaction if not previously exercised will receive a payment, if any, equal to the excess of the value of the property the participant would have received upon exercise of the stock award over the exercise price otherwise payable in connection with the stock award.

Under the 2026 Plan, a corporate transaction is generally the consummation of (1) a sale or other disposition of all or substantially all of our assets, (2) a sale or other disposition of at least 50% of our outstanding securities, (3) a merger, consolidation or similar transaction following which we are not the surviving corporation, or (4) a merger, consolidation or similar transaction following which we are the surviving corporation but the shares of common stock of all classes issued and outstanding immediately prior to such transaction are converted or exchanged into other property by virtue of the transaction.

A stock award may be subject to additional acceleration of vesting and exercisability upon or after a change in control as may be provided in an applicable award agreement or other written agreement, but in the absence of such provision, no such acceleration will occur.

Transferability. A participant may not transfer awards under our 2026 Plan other than by will, the laws of descent and distribution, or as otherwise provided under our 2026 Plan.

Plan Amendment or Termination. Our board of directors has the authority to amend, suspend or terminate our 2026 Plan, provided that such action does not materially impair the existing rights of any participant without such participant’s written consent. Certain material amendments also require the approval of our stockholders. No ISOs may be granted after the tenth anniversary of the date our board of directors adopted our 2026 Plan. No awards may be granted under our 2026 Plan while it is suspended or after it is terminated. ![]()

42

Notes

No additional comments.

Equity plans

The above is a typical description of the omnibus equity plan to be adopted by the company’s board and shareholders leading up to the IPO and effective at the pricing of the IPO. This would become the primary plan used for the grant of equity awards to employees, directors and consultants as a public company and would replace the company’s private company plan. We generally advise that these new plans be as comprehensive as possible at the time of IPO to allow for virtually all forms of equity awards, even those the company may not anticipate using at the time of IPO, since amending or adopting new plans once the company is public is significantly more difficult. Similarly, these plans very often include an “evergreen” provision, which allows for additional shares to be automatically added to the share reserve under the plan each year during the plan’s term (typically, 10 years), so that the company will continue to have a pool of shares available for grants to service providers over time. These provisions are not well liked by many shareholder advisory groups, but are often necessary to ensure the company’s ability to grow and attract and retain talent. A critical decision point leading up to the IPO will be the size of the initial share reserve and the evergreen replenishment each year based on the expected equity burn and dilution. Our compensation and benefits team works with companies and independent compensation consultants to create a plan, with a share pool structure, that works for them and their shareholders and has a great deal of market data to leverage in those discussions.

Note: If the company elects to adopt an employee stock purchase plan (ESPP) at the IPO, which allows for employees to directly purchase shares from the company at discounted prices and in a manner that qualifies for favorable tax treatment, that plan should be described here as well. Finally, a similar description of the legacy pre-IPO plan should be included as well, including a clear explanation of what will happen to any unused share reserve from the plan at IPO, which may be cancelled or rolled into the new post-IPO incentive plan, and any shares that might become available in connection with the cancellation, termination or expiration of outstanding equity awards under the prior plan.

Limitations of Liability and Indemnification Matters

Immediately prior to the closing of this offering, our amended and restated certificate of incorporation will contain provisions that limit the liability of our current and former directors for monetary damages to the fullest extent permitted by Delaware law. Delaware law allows a corporation to provide that its directors will not be personally liable for monetary damages for any breach of fiduciary duties as directors, except liability for:

- any breach of the director’s duty of loyalty to the corporation or its stockholders;

- any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

- unlawful payments of dividends or unlawful stock repurchases or redemptions; or

- any transaction from which the director derived an improper personal benefit.

Such limitation of liability does not apply to liabilities arising under federal securities laws and does not affect the availability of equitable remedies such as injunctive relief or rescission.

Our amended and restated certificate of incorporation that will be in effect immediately prior to the closing of this offering will authorize us to indemnify our directors, officers, employees, and other agents to the fullest extent permitted by Delaware law. Our amended and restated bylaws that will be in effect immediately prior to the closing of this offering will provide that we are required to indemnify our directors and officers to the fullest extent permitted by Delaware law and may indemnify our other employees and agents. Our amended and restated bylaws that will be in effect immediately prior to the closing of this offering will also provide that, on satisfaction of certain conditions, we will advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee, or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under the provisions of Delaware law. We have entered into, or will enter into in connection with this offering, agreements to indemnify our directors and executive officers. With certain exceptions, these agreements provide for indemnification for related expenses including attorneys’ fees, judgments, fines, and settlement amounts incurred by any of these individuals in connection with any action, proceeding, or investigation. We believe that our amended and restated certificate of incorporation and these amended and restated bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers. We also maintain customary directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our amended and restated certificate of incorporation and amended and restated bylaws may discourage stockholders from bringing a lawsuit against our directors for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and officers as required by these indemnification provisions.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted for directors, executive officers, or persons controlling us, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

43

Notes

No additional comments.