Index To Consolidated Financial Statements

LAZY SUSAN, Inc.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm |

| Consolidated Balance Sheets as of December 31, 2024 and December 31, 2023 |

| Consolidated Statements of Operations for the Fiscal Years Ended December 31, 2024 and December 31, 2023 |

| Consolidated Statements of Preferred Stock and Stockholders’ Deficit for the Fiscal Years Ended December 31, 2024 and December 31, 2023 |

| Consolidated Statements of Cash Flows for the Fiscal Years Ended December 31, 2024 and December 31, 2023 |

| Notes to Consolidated Financial Statements |

II-1

Notes

No additional comments

Financial statement requirements in registration statements

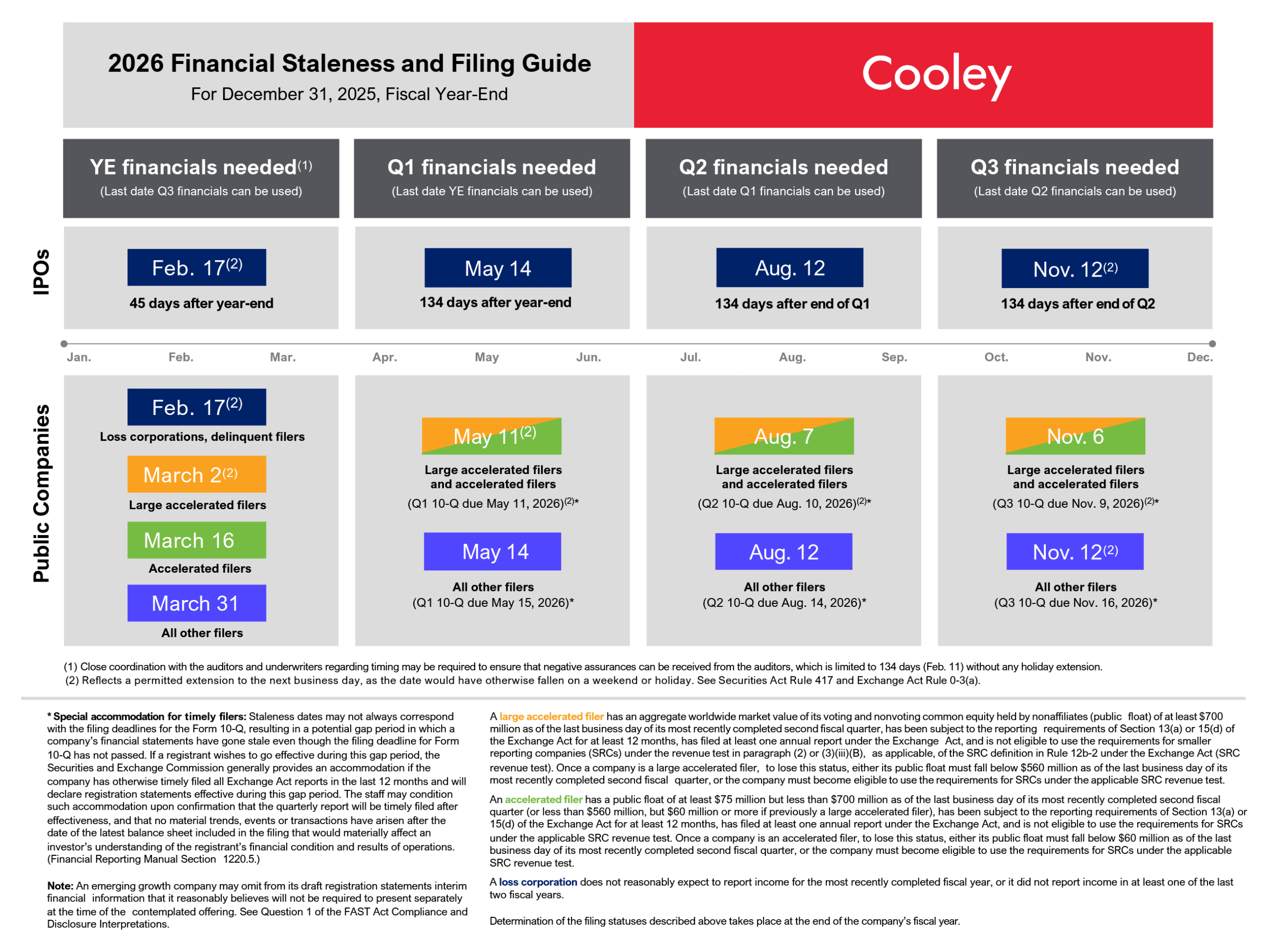

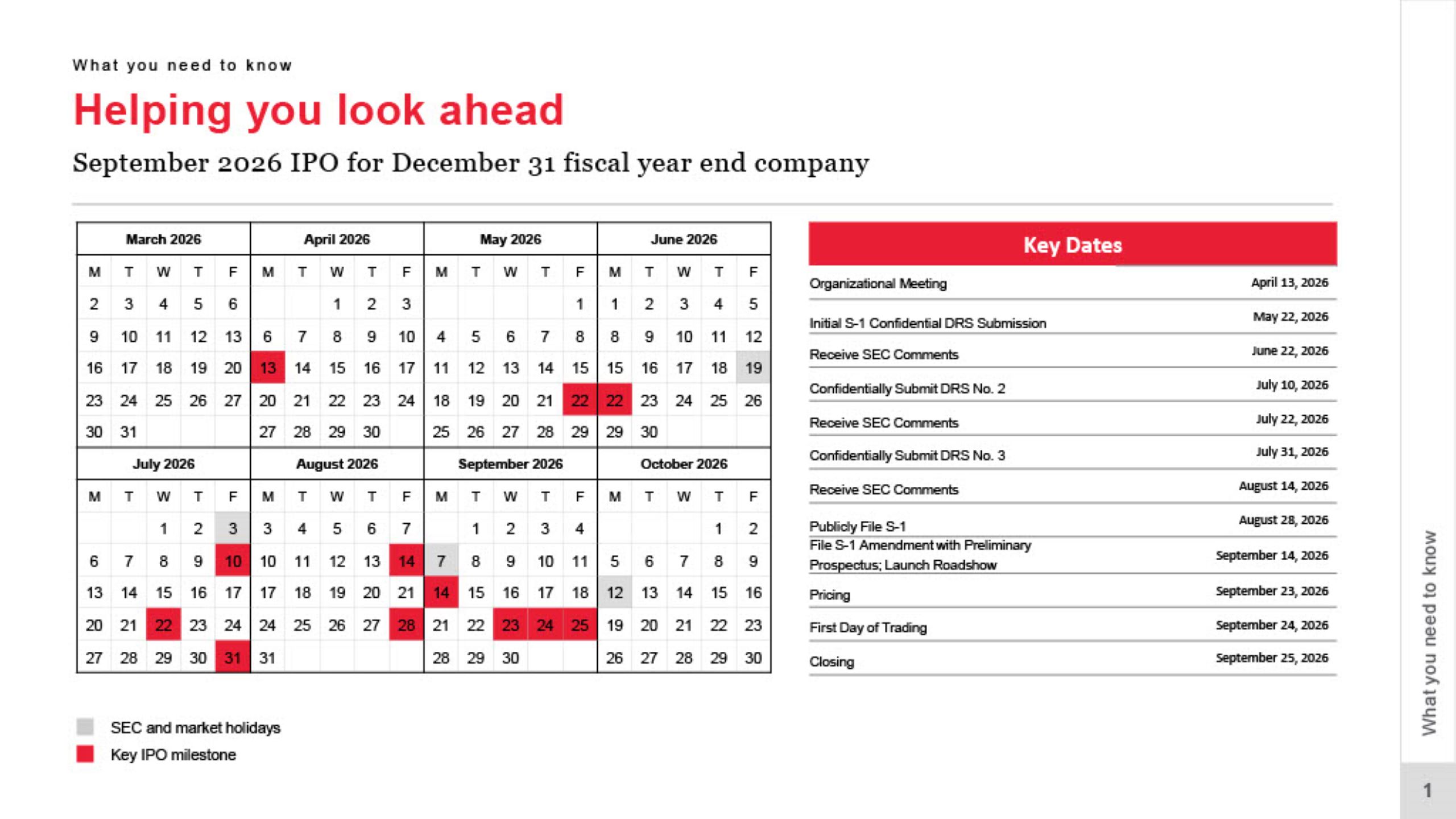

The company must include financial statements meeting the requirements of Regulation S-X (17 CFR Part 210), as well as any financial information required by Rule 3-05 and Article 11 of Regulation S-X. Companies generally will include three years of audited financial statements, although EGCs may elect to include only two years of audited financial statements. Companies that have switched auditors during that period should consult with both auditing firms, as the current auditing firm may need to re-audit prior years, or the previous auditors may need to include their audit of the prior years in the registration statement. Companies should also consider when quarterly interim financial statements will become available and understand the impact this will have on the timing of SEC filings. For additional information on financial staleness dates, see Cooley’s 2026 Financial Staleness and Filing Guide.

Companies that have undertaken acquisitions or other significant transactions should work with their advisors to understand what additional financial statements may be required in the registration statement, including pro forma financial statements and separate audited financial statements related to the acquired businesses.

Shares

Lazy Susan

Class A Common Stock

, 2026

II-2

Notes

No additional comments

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Unless otherwise indicated, all references to “Lazy Susan,” the “company,” “we,” “our,” “us,” or similar terms refer to Lazy Susan, Inc. and its subsidiaries.

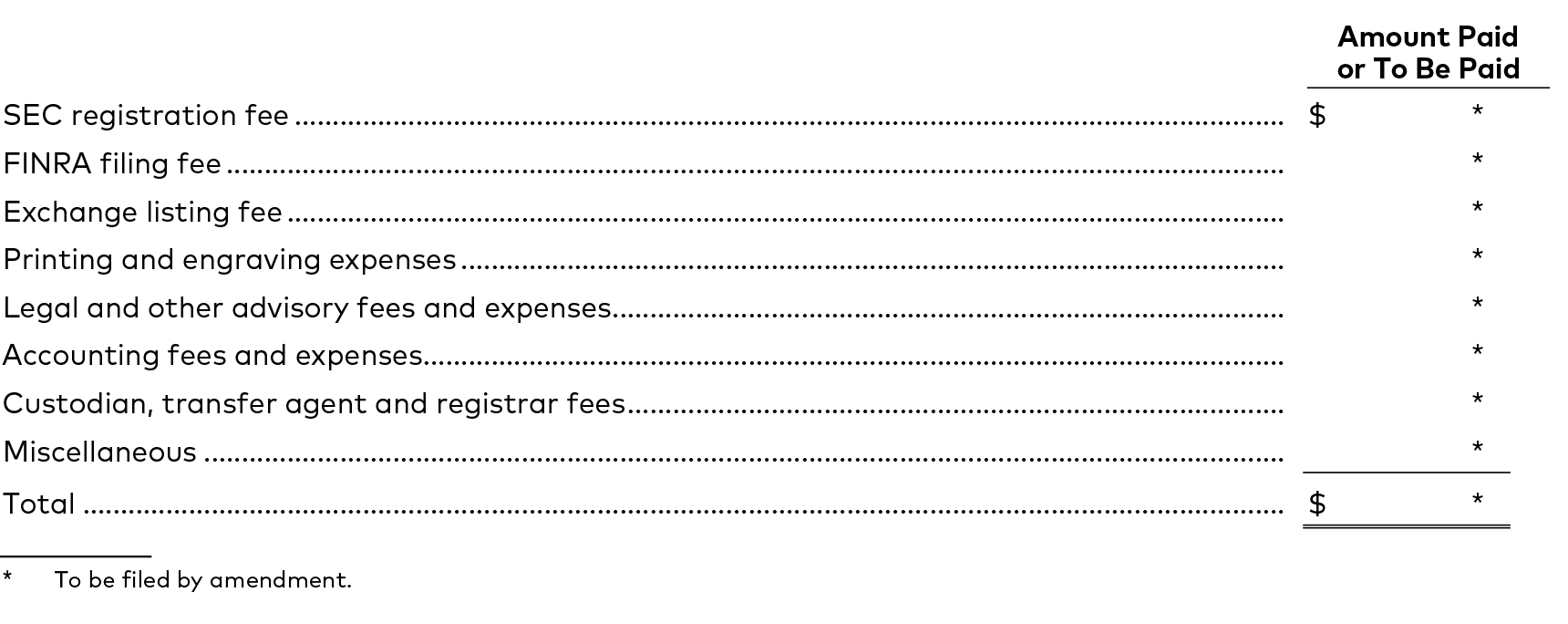

Item 13. Other Expenses of Issuance and Distribution.55

The following table sets forth all expenses to be paid by us, other than underwriting discounts and commissions, in connection with this offering. All amounts shown are estimates except for the SEC registration fee, the Financial Industry Regulatory Authority, Inc. (FINRA) filing fee and the exchange listing fee.

Item 14. Indemnification of Directors and Officers.56

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act of 1933, as amended (the Securities Act). Our amended and restated certificate of incorporation that will be in effect immediately prior to the completion of this offering permits indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General Corporation Law, and our amended and restated bylaws that will be in effect immediately prior to the completion of this offering provide that we will indemnify our directors and executive officers and permit us to indemnify our employees and other agents, in each case to the maximum extent permitted by the Delaware General Corporation Law.

We intend to enter into indemnification agreements with our directors and executive officers in connection with this offering, whereby we will agree to indemnify our directors and executive officers to the fullest extent permitted by the Delaware General Corporation Law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or executive officer was, or is threatened to be made, a party by reason of the fact that such director or executive officer is or was a director, executive officer, employee or agent of Lazy Susan, provided that such director or executive officer acted in good faith and in a manner that the director or executive officer reasonably believed to be in, or not opposed to, the best interests of Lazy Susan. At present, there is no pending litigation or proceeding involving a director or executive officer of Lazy Susan regarding which indemnification is sought, nor is the registrant aware of any threatened litigation that may result in claims for indemnification.

We maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the Securities Exchange Act of 1934, as amended, that might be incurred by any director or officer in his or her capacity as such.

The underwriters are obligated, under certain circumstances, under the underwriting agreement to be filed as Exhibit 1.1 hereto, to indemnify us and our officers and directors against liabilities arising under the Securities Act.

II-3

Item 15. Recent Sales of Unregistered Securities.57

From January 1, 2022 through , we have made the following sales of unregistered securities:

Equity Plan-Related Issuances

(1) Since January 1, 2023, we have issued to our directors, officers, employees, consultants and other service providers an aggregate of shares of our common stock at per share purchase prices ranging from $ to $ pursuant to exercises of options under our 2019 Plan.

(2) Since January 1, 2023, we have granted to our directors, officers, employees, consultants and other service providers options to purchase shares of our common stock with per share exercise prices ranging from $ to $ under our 2019 Plan.

(3) Since January 1, 2023, we have granted to our directors, officers, employees, consultants and other service providers an aggregate of restricted stock units.

Redeemable Convertible Preferred Stock Issuances

(4) In January 2023, we issued and sold an aggregate of shares of our Series A redeemable convertible preferred stock to accredited investors at a price per share of $ , for an aggregate purchase price of $ .

(5) In June 2023, we issued and sold an aggregate of shares of our Series B redeemable convertible preferred stock to accredited investors at a price per share of $ , for an aggregate purchase price of $ .

(6) In December 2024, we issued and sold an aggregate of shares of our Series C redeemable convertible preferred stock to accredited investors at a price per share of $ , for an aggregate purchase price of $ .

Redeemable Convertible Preferred Stock Warrant Issuances

(7) In June 2023, we issued warrants to purchase up to an aggregate of shares of our Series B redeemable convertible preferred stock to accredited investors. These warrants are net exercisable only and do not have a fixed exercise price.

The offers, sales and issuances of the securities described in paragraphs (1) through (3) were deemed to be exempt from registration under Rule 701 promulgated under the Securities Act as transactions under compensatory benefit plans and contracts relating to compensation, or under Section 4(a)(2) of the Securities Act as a transaction by an issuer not involving a public offering. The recipients of such securities were our directors, officers, employees, consultants or other service providers and received the securities under our equity incentive plans. Appropriate legends were affixed to the securities issued in these transactions. Each of the recipients of securities in these transactions had adequate access, through employment, business or other relationships, to information about us.

The offers, sales and issuances of the securities described in paragraphs (4) through (7) were deemed to be exempt under Section 4(a)(2) of the Securities Act or Rule 506 of Regulation D under the Securities Act as a transaction by an issuer not involving a public offering. The recipients of securities in each of these transactions acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends were affixed to the securities issued in these transactions. Each of the recipients of securities in these transactions was an accredited investor within the meaning of Rule 501 of Regulation D under the Securities Act and had adequate access, through employment, business or other relationships, to information about us. No underwriters were involved in these transactions.

Item 16. Exhibits and Financial Statement Schedules.58

(a) Exhibits.

The following exhibits are included herein or incorporated herein by reference:

|

Exhibit |

Description |

| 1.1* | Form of Underwriting Agreement. |

| 3.1 | Amended and Restated Certificate of Incorporation of the Registrant, as currently in effect. |

| 3.2* | Form of Amended and Restated Certificate of Incorporation of the Registrant, to be in effect upon the completion of the offering. |

| 3.3 | Bylaws of the Registrant, as currently in effect. |

| 3.4* | Form of Amended and Restated Bylaws of the Registrant, to be in effect upon the completion of the offering. |

| 4.1* | Amended and Restated Investors’ Rights Agreement, by and among the registrant and certain holders of its capital stock, dated as of July 21, 2024. |

| 5.1* | Opinion of Cooley LLP. |

| 10.1*+ | Lazy Susan, Inc. 2019 Equity Incentive Plan, as amended, and related forms of agreements thereunder. |

| 10.2*+ | Lazy Susan, Inc. 2026 Equity Incentive Plan and related forms of agreements thereunder. |

| 10.3*+ | Lazy Susan, Inc. 2026 Employee Stock Purchase Plan. |

| 10.4*+ | Form of Indemnification Agreement between the Registrant and each of its directors and executive officers. |

| 10.5*+ | Employment Agreement, by and between the Registrant and V. Jah Neri, dated May 4, 2025. |

| 10.6* | Lease Agreement, dated October 5, 2020, by and between the Registrant and . |

| 21.1* | Subsidiaries of the Registrant. |

| 23.1* | Consent of Cooley LLP (included in Exhibit 5.1). |

| 23.2* | Consent of , independent registered public accounting firm. |

| 24.1* | Power of Attorney (included on signature page to this registration statement). |

| 107* | Filing Fee Table. |

_________________________

| * | To be submitted by amendment. |

| + | Indicates management contract or compensatory plan. |

II-4

Notes

57 The company must provide information regarding recent sales (within the last three years) of unregistered securities as set forth in Item 701 of Regulation S-K. This will include, for example, any issuances of stock options or restricted stock units to employees, preferred stock issuances and warrant issuances.

58 The company must file the required exhibits to Form S-1 as set forth in Item 601 of Regulation S-K. The SEC requires all material contracts to be filed as exhibits, which may include contracts made in the ordinary course if, for example, a contract with a related party, a contract on which the company is substantially dependent or a material lease. The company will also need to determine whether notice must be given to third parties and/or consent obtained to disclose the terms of any of the filed exhibits.

(b) Financial Statement Schedule.

All financial statement schedules are omitted because the information required to be set forth therein is not applicable or is shown in the consolidated financial statements or the notes thereto.![]()

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes to provide to the underwriters at the closing specified in the underwriting agreement certificates in such denominations and registered in such names as required by the underwriters to permit prompt delivery to each purchaser.

(b) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant under the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

(c) The undersigned registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance on Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

II-5

Notes

No additional comments

Exhibits to the registration statement

SEC rules require you to publicly file material agreements. Determine which agreements will likely be required to be filed and review these agreements for confidentiality provisions that will need to be waived by the counterparty. Also, determine which terms, if any, of these agreements would be competitively harmful if disclosed. Discuss with your counsel the process of obtaining confidential treatment for these provisions in connection with your IPO, and provide your counterparties with an opportunity to review and comment on any proposed redactions. The SEC adopted rules providing deference to companies in making these determinations as to what provisions may be redacted, but the rules regarding eligibility for confidential treatment have not changed, and the SEC may still comment on redactions that it deems to be inappropriate. Getting this right requires careful analysis and can take some time.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in San Francisco, California on , 2026.

| LAZY SUSAN, INC. | |

| By: | ________________________ |

| Name: | V. Jah Neri |

| Title: | Chief Executive Officer and Director |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoint V. Jah Neri, Moe Neeman and Rick Fastors, and each one of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in their name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to sign any registration statement for the same offering covered by this registration statement that is to be effective on filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.59

|

Signature

|

Title

|

Date

|

|

________________________ V. Jah Neri |

Chief Executive Officer and Director (Principal Executive Officer) |

, 2026 |

|

________________________ Moe Neeman |

Chief Financial Officer (Principal Financial and Accounting Officer) |

, 2026 |

|

________________________ Emir Itus, Ph.D. |

Chair of the Board | , 2026 |

|

________________________ Augh Ditchare |

Director | , 2026 |

|

________________________ Vee C. Funz |

Director | , 2026 |

|

________________________ Inda Streepro |

Director | , 2026 |

II-7

Notes

59 The registration statement is signed (at the time of “public flip”) by the company, its principal executive officer or officers, its principal financial officer, its controller or principal accounting officer and by at least a majority of the board of directors or persons performing similar functions.

Notes

No additional comments.

Notes

No additional comments.