Management

Section summary: This section provides an overview of the management team that is (or will be) running the company once it is public and highlights the relevant experiences and qualifications of the company’s leadership team, consisting of both the executive officers and members of the board of directors. This section is particularly important as it informs investors about who will be executing the business model (as described at length in the “Business” section), including managing and monitoring the day-to-day operations of the company. The expertise and experience of the leadership team may help inform investors how well the company will transition into and succeed as a public company, effectively use the capital raised, implement its business strategy, meet investor demands and generally plan for the future. Items 401 through 404 of Regulation S-K require disclosure of certain information regarding directors, executive officers and key employees.

MANAGEMENT

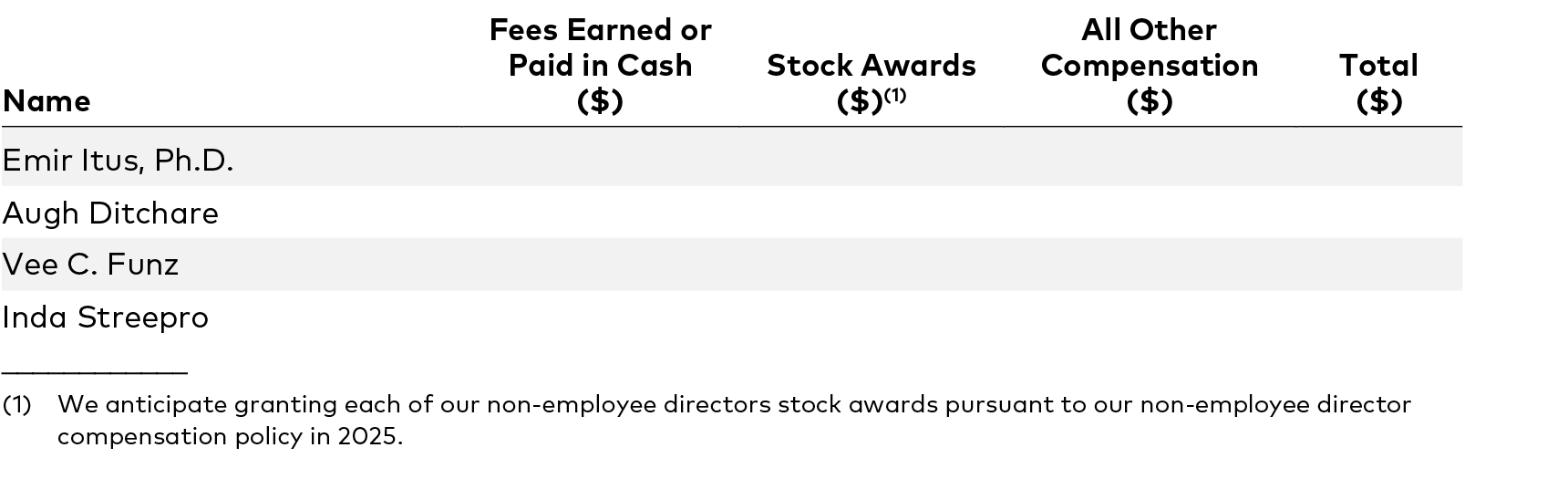

Executive Officers and Directors![]()

This table sets forth information for our directors and executive officers, and their ages as of December 31, 2024.37

V. Jah Neri has served as our Chief Executive Officer and as a member of our board of directors since our inception.38 Prior to founding Lazy Susan, Mr. Neri served as President and Chief Executive Officer of Stepping Stone Enterprises, an international geolocation company, from July 2015 to June 2018. Mr. Neri currently serves on the board of directors of Frenetic Fannie, Inc., a global social media aggregation firm.39 Mr. Neri received a Master’s Degree in computer engineering from the Massachusetts Institute of Technology and a B.S. in clinical psychology from Harvard University.

Mr. Neri was selected to serve on our board of directors based on the perspective and experience he brings as our Chief Executive Officer, his innovation, technology and high-growth experience, consumer and digital experience, and his financial expertise.4041

Non-Employee Directors

Dr. Emir Itus has served as the Chair of our board of directors since December 2018. Dr. Itus was Chair of the board of directors and Chief Executive Officer of Bigtechly, Inc., a digital integration platform company, from January 2012 until her retirement in November 2017. Dr. Itus also serves as a director of Swipe, Inc., a social media platform for petty thieves, and Harpoon Mates, Inc., a dating app for lonely sailors. Dr. Itus received a Ph.D. in economics from Cornell University and a B.A. in political science from Brown University.

Dr. Itus was selected to serve on our board of directors because of her experience as the leader of a global company, particularly as Chair of the Board and Chief Executive Officer of Bigtechly, her innovation, technology and high-growth experience, consumer and digital experience, and her financial expertise.

Family Relationships

There are no family relationships among any of the directors or executive officers.42

28

Notes

37 List the names and ages of all directors and executive officers of the company and all persons nominated or chosen to become directors or executive officers. In an IPO prospectus, it is common to include director nominees who will take office upon the closing of the IPO. These director nominees must be listed in the document and provide a consent to act as such pursuant to Rule 438 under the Securities Act of 1933.

38 As applicable, disclose all positions and offices within the company held by each such director, executive officer or nominee, along with the term of office and the periods the person served in that position of the company, without regard to the five-year lookback period that applies for outside positions. This disclosure is especially relevant in connection with determining director and audit committee independence. Director independence requirements, including the requirements for each board committees of the NYSE and Nasdaq, are discussed below.

39 List any other directorships of public companies held by each director or person nominated or chosen by the company to become a director during the past five years. It should be noted that overinclusion of board positions is viewed in a negative light and may result in an unintended comment from Institutional Shareholder Services (ISS). For example, ISS generally recommends a withhold vote with regard to a director at a company’s annual stockholders meeting if that director serves on too many boards of directors. In addition, the SEC has, in the past, commented with regard to outside directorships in the area of special purpose acquisition companies (SPACs), requesting supplemental disclosure regarding the director’s background related to the SPACs with which the director was affiliated, as well as whether each such company completed a business combination or changed its intentions from those disclosed in its IPO prospectus.

40 Discuss the specific experience, qualifications, attributes or skills that led to the conclusion that the person nominated or chosen by the company should serve as a director. See Item 401(f) of Regulation S-K.

41 While not as common, to the extent applicable, disclose any arrangement (e.g., financing arrangements) or understanding between the director, executive officer or nominee and any other person (naming such person) pursuant to which he or she was or is to be selected as a director, officer or nominee (see Item 401(a) and Item 401(b) of Regulation S-K). In addition, furnish a description of certain legal or regulatory proceedings during the past 10 years involving any director, person nominated to become a director or executive officer of the company. The SEC staff has stated that such disclosure may be material to an evaluation of the ability or integrity of any such proceedings (e.g., personal bankruptcy) or convictions (e.g., securities or tax fraud). See Item 401(f) of Regulation S-K.

42 Disclose the nature of any family relationship between any director, executive officer or person nominated or chosen by the company to become a director or executive officer. “Family relationship” is defined to mean any relationship by blood, marriage or adoption, not more remote than first cousin. This information would generally come from the company’s responses to the directors and officers questionnaires. See Item 401(d) of Regulation S-K.

Executive officers

The SEC defines an “officer” in Rule 16a-1(f) and an “executive officer” in Rule 3b-7, both under the Securities Exchange Act of 1934. The former defines the term “officer” as the president, principal financial officer, principal accounting officer, any vice president of the issuer in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the issuer. The latter defines the term “executive officer” as the president, any vice president of the registrant in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the registrant. Note that the Section 16 definition of “officer” encompasses all of the persons defined in the Rule 3b-7 definition of “executive officer.” As such, in most cases, any person identified as an executive officer will be a Section 16 reporting officer, and vice versa. Once deemed an executive officer, Item 401 of Regulation S-K requires disclosure of, among other things, the executive officer’s name, age, positions held, term of office and any arrangements that caused such officer’s appointment. It is also important to keep in mind that an “executive officer” may fall within the narrower definition of “named executive officer” under Item 402 of Regulation S-K.

It is important to keep in mind that the determination of whether an officer is an “executive officer” is not solely based on title, and that other factors can come into play – such as the company’s internal politics. Sometimes, a person may be deemed an “executive officer,” even though that person may not have an important policy-making function, but simply due to the influence or importance of the individual within the organization. On the flipside, some people prefer not to be deemed an “executive officer” due to various burdens and additional requirements.

Given that being deemed an executive officer under Rule 3b-7 likely means that the person will also be deemed a Section 16 officer, such executive officer will be subject to Section 16 filing obligations (namely Forms 3, 4 and 5). Not only is the actual reporting of these forms a hassle (and oftentimes costly), but the principal downside is that the public can view the ownership, including changes in ownership, and the types of securities the executive officer is holding. There are other burdens to being deemed a Section 16 officer that are outside the scope of this project.

For an overview of the various definitions of officer and their corresponding obligations, check out “Are You an Officer?”

Management biographies

At a technical level, the degree of disclosure required in the biographies included in the “Management” section is set forth in Item 401 of Regulation S-K. The purpose is to enable investors and stockholders to evaluate the management of the public company. It is notable that the drafting styles for management biographies vary greatly among different companies, perhaps more so than other areas of the prospectus. Whereas some biographies consist of a few sentences about an officer’s or director’s current occupation and background, others may fill more than half a page detailing the business experience and various qualifications of the leadership team. Best practice is probably somewhere in between, ensuring the disclosure complies with the requirements set forth in Item 401, while adding relevant details to highlight the positive attributes and qualifications of the leadership team and ultimately help investors and stockholders make informed assessments.

Our board of directors and leadership team firmly believe that we must be transparent with, and accountable to, our stockholders with respect to our culture, corporate governance practices, stockholder engagement, corporate responsibility and sustainability, and human capital development. We strive to maintain the highest governance standards in our business. Our commitment to effective corporate governance is illustrated by the following practices:

Appointment of Officers

Our executive officers are appointed by, and serve at the discretion of, our board of directors. There are no family relationships among any of our directors or executive officers.

Our board of directors currently consists of seven members, all of whom serve pursuant to the provisions of a voting agreement between us and certain of our stockholders. This agreement will terminate upon the closing of this offering.

The Board has determined that each of the directors on the Board other than Mr. Neri will qualify as independent directors, as defined under the listing rules of [the NYSE][Nasdaq] (the Listing Rules), and the Board consists of a majority of “independent directors,” as defined under the Listing Rules relating to director independence requirements. In addition, we are subject to the rules of the Securities and Exchange Commission (SEC) and the Listing Rules relating to the membership, qualifications and operations of the audit committee, as discussed below.

Committees of Our Board of Directors![]()

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors. Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

Audit Committee43

Our audit committee consists of Augh Ditchare, and . Mr. Ditchare is the chair of our audit committee. The composition of our audit committee meets the requirements for independence under the rules of [the NYSE][Nasdaq] and Rule 10A-3 of the Exchange Act. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Mr. Ditchare is an “audit committee financial expert” within the meaning of the SEC rules. This designation does not impose on such directors any duties, obligations, or liabilities that are greater than those generally imposed on members of our audit committee and our board of directors. The principal duties and responsibilities of our audit committee include, among other things:

- selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

- helping to ensure the independence and performance of the independent registered public accounting firm;

29

Notes

43 An audit committee is a committee of board members to whom the board has delegated the responsibility of supervising accounting practices, financial reporting, engagement of external auditors, risk management policies and regulatory compliance. U.S. companies are required to have an audit committee as a precondition to being listed on a stock exchange. Audit committee members are drawn from the board of directors, and at least one must have financial experience and expertise (but ideally all members would have this kind of expertise), who would be an “audit committee financial expert” as defined by SEC rules. Under NYSE and Nasdaq rules, all public companies must have an audit committee consisting of at least three directors who are not only NYSE- or Nasdaq-independent but also SEC-independent.

Corporate governance practices

Following the biographies of management, you should discuss the composition of the board of directors, including a statement of director independence. Next, you should describe the purposes and members of the different committees, statements of the board’s code of business conduct and ethics, and board member compensation. Note that, due to the extensive disclosures that go into this topic, some companies separate corporate governance as a stand-alone section, usually after the “Management” section. The SEC staff has regularly prioritized its review of corporate governance disclosure not only in IPO registration statements, but also in proxy statements and periodic reports. Much of this required disclosure, especially with regard to board member independence and board committee composition, is effectuated through the rules of national securities exchanges, namely the NYSE and Nasdaq, as a result of the Sarbanes-Oxley Act of 2002 (SOX), which applies to IPO companies once their registration statement is filed and the company is deemed an “issuer.”

If the company does not have any independent directors or fewer than a majority of independent directors on its board of directors, the SEC would likely advise the company to add disclosure in the “Risk Factors” section of the document regarding this lack of independent directors and its effect on the company. If all of the directors are also executive officers of the company, the SEC may recommend addressing this risk with language to the effect that such directors may be able to determine their own compensation and benefits, and this may negatively affect the company’s profitability. Other risks to shareholders based on deviation from such standards of corporate governance might include the possibility of related-party transactions and conflicts of interest, as well as reluctance by investors to provide capital to the company in the future.

Board composition

As discussed above, various constituents, such as the SEC, stock exchanges, individual and institutional investors, as well as proxy advisors such as Institutional Shareholder Services (ISS) or Glass Lewis, are increasingly focused on ensuring that a company has sound corporate governance policies and practices in place. Key considerations include whether the board and committee compositions meet the minimum stock exchange requirements, whether the company is in compliance with SOX requirements, and whether the company meets the standards or recommendations set forth by ISS and Glass Lewis. As this section is drafted (and perhaps earlier in the IPO process), legal counsel should work closely with the company to ensure that the company is prepared to meet such corporate governance requirements and approaches the decision-making process strategically.

ISS and Glass Lewis are the two most prominent proxy advisory services in the United States. Because institutional investors hold a large number of different stocks at any point in time, they tend to need assistance in voting their shares come annual meeting time. This is where ISS and Glass Lewis come in. Many institutional investors follow their recommendations, which are regularly evaluated and updated annually. ISS and Glass Lewis are widely thought to have a meaningful impact on companies, including on shareholder engagement strategies and voting outcomes of various corporate activities.

Describe the board structure in detail, including whether the board will be staggered and which directors will be appointed for each class. Also, explain in reasonable detail how the board structure may change in accordance with the company’s governing documents.

There are many opportunities for director education, which Cooley has compiled.

Director independence

While the precise definition of independence is not always clear, generally speaking, an “independent director” is an individual who is able to exercise unbiased judgment in the best interest of the company, independent of the influence of company management or other family, personal or business relationships. Without going into much detail, the NYSE and Nasdaq rules enumerate a list of relationships that, on its face, will disqualify a director from being independent. These include, for example, whether they are a current officer or other employee of the company or directly or indirectly receive certain payments (i.e., more than $120,000) from the company other than in their capacity as a member of the board in any 12-month period, subject to a look-back period. Meanwhile, SOX and SEC rules are more restrictive in that they preclude an individual from serving on the audit committee if such person is receiving any, even de minimis, compensatory payments from the company other than in their capacity as a board or committee member, or if such person is an “affiliate” of the company other than in their capacity as a director. In addition, pursuant to the Dodd-Frank Act, the stock exchanges have adopted enhanced compensation committee independence requirements.

Both Nasdaq and the NYSE require that the majority of the members of the board of directors of a listed company consist of directors meeting the independence requirements of the relevant stock exchange, whereas many institutional investors prefer that a “substantial” majority of a company’s directors be independent. While the NYSE and Nasdaq provide newly public companies a grace period to achieve compliance, it is advisable that the majority of the board be independent at the time of the IPO, especially since institutional investors (and as a result, ISS and Glass Lewis) have become increasingly focused on this aspect of a company’s governance at the outset.

Board committee requirements

A solid committee system is a crucial element of an effectively functioning board. The rules of SOX, the NYSE and Nasdaq, and the SEC prescribe the existence, composition and many of the activities of three core committees: the audit committee, compensation committee, and nominating and corporate governance committee. While all public companies listed on the NYSE or Nasdaq must have an audit committee and compensation committee, Nasdaq does not technically require a nominating and corporate governance committee.

Recently, the increasing importance and greater focus on function expertise in cybersecurity issues and ESG issues prompted the introduction of stand-alone committees in these specific areas for many companies, although they are not required by any national stock exchange to date. Not only have legal and regulatory demands on companies emphasized the need to safeguard sensitive corporate data, but institutional investors, proxy advisory firms (e.g., ISS and Glass Lewis) and other market participants have stressed the focus on cybersecurity oversight. In the case of ESG, which encompasses a broad set of issues ranging from climate change to human capital considerations, all of which are important for corporate disclosure and investment purposes, many companies are considering enhanced board oversight of, and management responsibility for, business-relevant ESG issues.

- helping to maintain and foster an open avenue of communication between management and the independent registered public accounting firm;

- discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results;

- developing and overseeing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

- reviewing our policies on risk assessment and risk management, including information security policies and practices;

- overseeing the organization and performance of our internal audit function;

- establishing our investment policy to govern our cash investment program;

- reviewing related party transactions;

- obtaining and reviewing a report by the independent registered public accounting firm at least annually that describes its internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and

- approving (or, as permitted, pre-approving) all audit and all permissible non-audit services to be performed by the independent registered public accounting firm.

Our audit committee operates under a written charter that satisfies the applicable listing standards of [the NYSE][Nasdaq].

Compensation Committee

Our compensation committee consists of Inda Streepro, and . Ms. Streepro is the chair of our compensation committee. Each of Ms. Streepro and meets the requirements for independence under the rules of [the NYSE][Nasdaq]. The principal duties and responsibilities of our compensation committee include, among other things:

- approving the retention of compensation consultants and outside service providers and advisers;

- reviewing and approving, or recommending that our board of directors approve, the compensation, individual and corporate performance goals and objectives and other terms of employment of our executive officers, including evaluating the performance of our Chief Executive Officer and, with his assistance, that of our other executive officers;

- reviewing and recommending to our board of directors the compensation of our directors;

- administering our equity and non-equity incentive plans;

- reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives;

- reviewing and evaluating succession plans for our executive officers and making recommendations to our board of directors with respect to the selection of appropriate individuals to succeed these positions;

- preparing the compensation committee report required to be included in our proxy statement under the rules and regulations of the SEC;

- reviewing and approving, or recommending that our board of directors approve, incentive compensation and equity plans; and

- reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy.

Our compensation committee operates under a written charter that satisfies the applicable listing standards of [the NYSE][Nasdaq].

Nominating and Corporate Governance Committee44

Effective upon the completion of this offering, our nominating and corporate governance committee will consist of Vee C. Funz, and . Mr. Funz will be the chair of our nominating and corporate governance committee, and meets the requirements for

30

Notes

44 One of the primary duties of the nominating and corporate governance committee is to seek out and evaluate potential candidates to fill senior management positions and board membership roles. Also, importantly, the nominating and corporate governance committee conducts general oversight of the board. Only the NYSE technically requires a nominating committee, which must consist solely of NYSE-independent directors. Nasdaq, while it does not require a committee, requires that director nominations are determined or recommended by a majority of the independent directors.

independence under the rules of [the NYSE][Nasdaq]. The nominating and corporate governance committee’s responsibilities include, among other things:

- identifying, evaluating and recommending that our board of directors approve nominees for election to our board of directors and its committees;

- approving the retention of director search firms;

- evaluating the performance of our board of directors, committees of our board of directors, and of individual directors;

- considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; and

- evaluating the adequacy of our corporate governance practices and reporting.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of [the NYSE][Nasdaq].45

Code of Conduct and Ethics

We have adopted a code of conduct and ethics that applies to all our employees, officers, contractors and directors. This includes our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. The full text of our code of conduct and ethics is posted on our website at www.lazysusan.biz. We intend to disclose on our website any future amendments of our code of conduct and ethics or waivers that exempt any principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions, or our directors from provisions in the code of conduct and ethics. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Stock Ownership Guidelines

In an effort to align our directors’ and executive officers’ interests with those of our stockholders, we have adopted stock ownership guidelines to be effective in connection with this offering. Within five years of becoming subject to the guidelines, our non-employee directors are expected to hold Lazy Susan stock valued at not less than five times their total annual cash retainer for board and committee service. Within five years of becoming subject to the guidelines, our executive officers are expected to hold Lazy Susan stock valued at not less than a multiple of their annual base salaries, consisting of five times annual base salary for our Chief Executive Officer and Chief Financial Officer, and two times annual base salary for our other executive officers.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee are currently, or have been at any time, one of our officers or employees, except Mr. Neri, who served as our Chief Executive Officer and Chief Financial Officer from December 2020 to June 2024. None of our executive officers currently serve, or have served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Non-Employee Director Compensation Policy

Prior to this offering, we did not have a formal policy with respect to compensation payable to our non-employee directors for service as directors. From time to time, we have granted equity awards to certain non-employee directors to entice them to join our board of directors and for their continued service on our board of directors. We also have reimbursed our directors for expenses associated with attending meetings of our board of directors and committees of our board of directors.

In December 2024, our board of directors approved a director compensation policy for non-employee directors to be effective in connection with this offering. Our policy is to reimburse directors for reasonable and necessary out-of-pocket expenses incurred in connection with attending Board and committee meetings or performing other services in their capacities as directors. Pursuant to this policy, our non-employee directors will receive the following compensation.

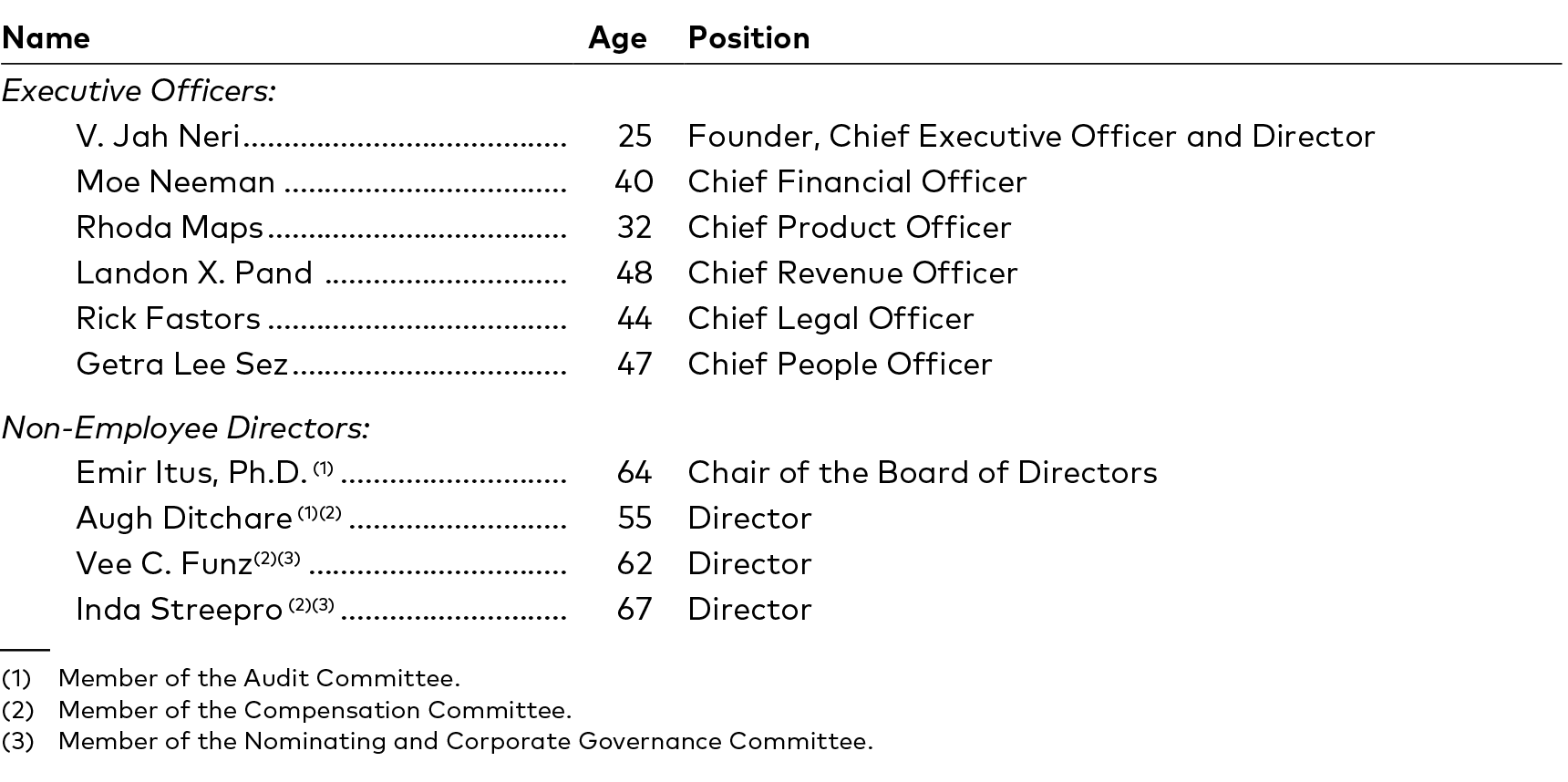

Non-Employee Director Compensation

The following table contains information concerning the compensation of our non-employee directors in fiscal year 2024.

31

Notes

45 In addition to analyzing the “independence” of the proposed directors and satisfying the board and committee composition requirements, companies will also need to adopt committee charters and, among other things, a code of ethics and corporate governance policy, and develop adequate internal and disclosure controls.

We believe that good governance starts with an effective and diverse Board that has the right mix of skills, expertise, and qualifications that align with our strategic needs for the future. Under our corporate governance guidelines, which will become effective upon the closing of this offering, the nominating and governance committee considers several critical factors when evaluating the composition of our board of directors, among other critical selection criteria, including (i) integrity, (ii) sound business judgment, (iii) commitment to the highest ethical standards, (iv) background, (v) skills and relevant business experience, (vi) ability and willingness to commit time to the board of directors and represent long-term interests of stockholders, (vii) diversity factors, and (viii) expected contributions to the board of directors. For a company like ours, which operates in 35 countries around the globe, factors that are considered to strengthen and increase the diversity, breadth of skills, and qualifications of the Board may include race, ethnicity, sexual orientation, gender, national origin, and geography. Our board of directors currently includes two women, three ethnic minorities, directors ranging in age from 25 to 67, and directors with a range of geographic diversity.

32

Notes

No additional comments.

Non-employee director compensation – narrative description

Companies should include a narrative description following the table of its non-employee director compensation program, including cash and equity compensation for service on the board and committees of the board and any expense reimbursement or other compensation arrangements. To the extent the company has adopted other non-employee director policies around experience, tenure, term limits and/or diversity requirements, the company should include a detailed description of that as well. The samples listed herein represent thoughtful disclosure around board diversity and broader employee diversity and inclusion programs.