Principal Stockholders

Section summary: Item 403 of Regulation S-K requires disclosure of the security ownership of the company’s directors, named executive officers, all of the company’s directors and executive officers as a group, and anyone beneficially holding more than 5% of any class of the company’s voting securities. Such security ownership is presented in tabular format, accompanied by footnotes that detail the shares or other interests held by the parties in the table. Item 507 of Regulation S-K also requires identification of securityholders selling in the offering in this section.

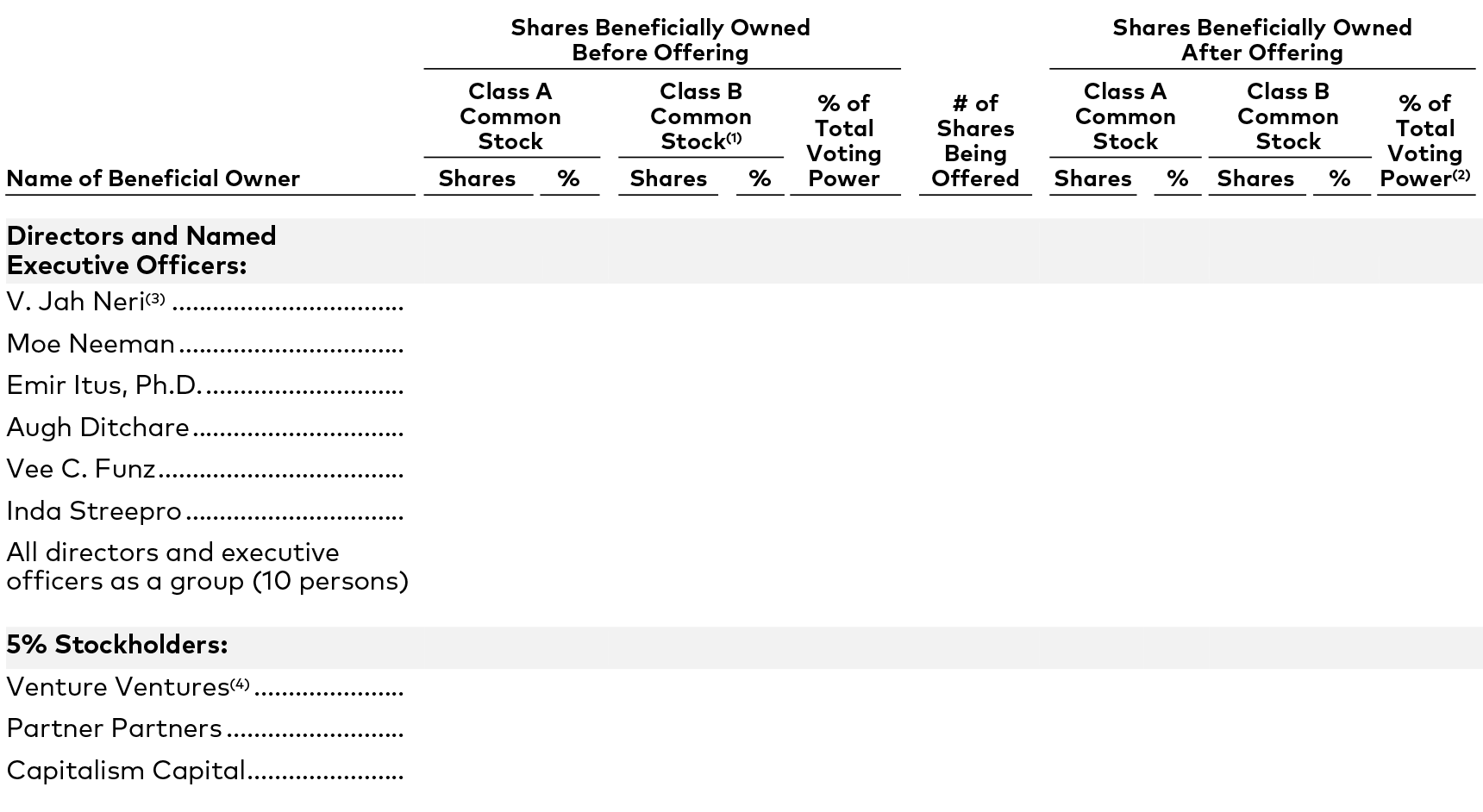

PRINCIPAL STOCKHOLDERS

The following table sets forth information with respect to the beneficial ownership of our shares as of December 31, 2024 by:

- each of our named executive officers;

- each of our directors;

- all of our directors and executive officers as a group; and

- each person or entity known by us to own beneficially more than 5% of our common stock.

The percentage ownership information under the column titled “Shares Beneficially Owned Before Offering” is based on shares of Class A common stock and shares of Class B common stock outstanding as of December 31, 2024, after giving effect to the Reclassification and Exchange, which will occur immediately prior to the completion of this offering. The percentage ownership information under the column titled “Shares Beneficially Owned After Offering” is based on shares of Class A common stock and shares of Class B common stock outstanding immediately after the completion of this offering, after giving effect to the sale of shares of Class A common stock by us in this offering, and assuming no exercise by the underwriters of their option to purchase additional shares.

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that security, including options that are currently exercisable or exercisable within 60 days of December 31, 2024. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all shares of Class A common stock and Class B common stock shown that they beneficially own, subject to community property laws where applicable. The information does not necessarily indicate beneficial ownership for any other purpose.

Shares of Class A common stock issuable pursuant to the exercise of options that are currently exercisable or exercisable within 60 days of December 31, 2024 are deemed to be outstanding for computing the percentage ownership of the person holding these options and the percentage ownership of any group of which the holder is a member but are not deemed outstanding for computing the percentage of any other person.

Unless otherwise noted below, the address for each beneficial owner listed in the table below is c/o Lazy Susan, Inc., 85 Soma Street, San Francisco, California.

* Represents beneficial ownership of less than 1%.

(1) The Class B common stock is convertible at any time by the holder into shares of Class A common stock on a share-for-share basis.

(2) Percentage of total voting power represents voting power with respect to all shares of our Class A common stock and Class B common stock, as a single class. The holders of our Class B common stock are entitled to 10 votes per share, and holders of our Class A common stock are entitled to one vote per share. See the section titled “Description of Capital Stock—Voting Rights” for more information about the voting rights of our Class A common stock and Class B common stock.

(3) Consists of shares of Class B common stock subject to outstanding options that are exercisable within 60 days of December 31, 2024.

(4) Consists of (i) shares of Class B common stock held by and (ii) shares of Class B common stock held by . Mr. has shared voting and dispositive power over shares held by . Mr. and his wife, , share voting and dispositive power over the shares held by . The address for is .

46

Notes

No additional comments.