Based on an analysis of more than 225 US IPOs from 2017 through 2021, this inaugural report explores how governance structures evolve in a company’s

first years after IPO

Calm on the surface, storm under the sea

At first glance, the governance structures of newly public companies seem steady. Key governance structures baked into bylaws and charters established at initial public offering (IPO) often remain untouched, and on the surface, the early years appear drama free.

At first glance, the governance structures of newly public companies seem steady. Key governance structures baked into bylaws and charters established at initial public offering (IPO) often remain untouched, and on the surface, the early years appear drama free.

But beneath that calm, there’s movement. Boards evolve, leadership turns over, shareholder voting trends shift and expectations around compensation and governance continue to rise. Far from static, a company’s first years after IPO are anything but quiet.

This report is designed to help you anticipate those shifts. Whether you’re preparing to go public or navigating the early days post-IPO, it offers a clear view of how your peers have adapted governance and what challenges may lie ahead.

Primary authors: Michael Mencher and Vince Flynn

Associate contributors: Alexandria Ashour, Lukhan Baloch, Jordan Cohen, Nikki Chang DiFedrico, Julia Gage, Nate Hearn, Kelly McCormick, Breanna Qin, Charlotte Yin, and Samara Zaifman

Partner team: Dave Peinsipp, Brad Goldberg, Beth Sasfai, Jon Avina, and Milson Yu

What’s inside

- Evolving governance structures: An examination of the standard governance structures adopted at the time of IPO and how they evolve as companies mature, so you can benchmark your own governance approach against the market standard.

- Trends in voting outcomes: An overview of annual meeting voting developments to see where shareholders are patient and where they provide early pushback.

- Shifts in board and leadership: An analysis of how boards and executive teams change in the post-IPO period – and where there is more stickiness.

- Progressions in governance, compensation and disclosure practices:

An evaluation of how newly public companies evolve their governance and compensation policies and proxy disclosures to meet investor and other stakeholder expectations.

Sample pages

Download the full report now

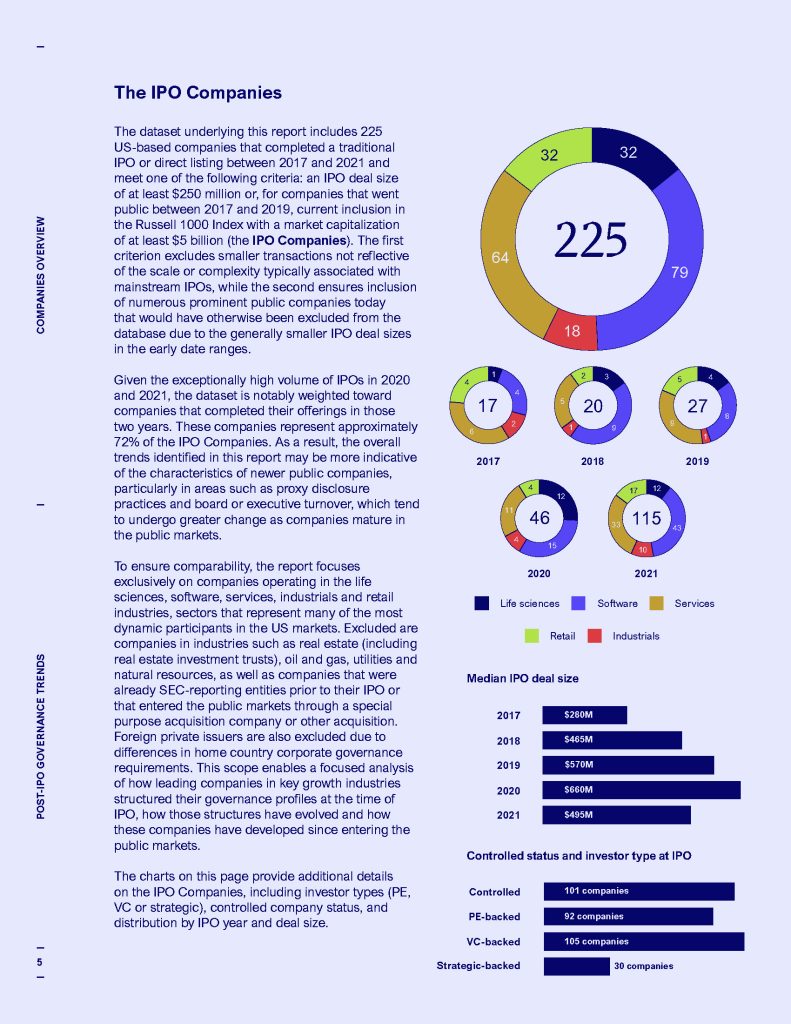

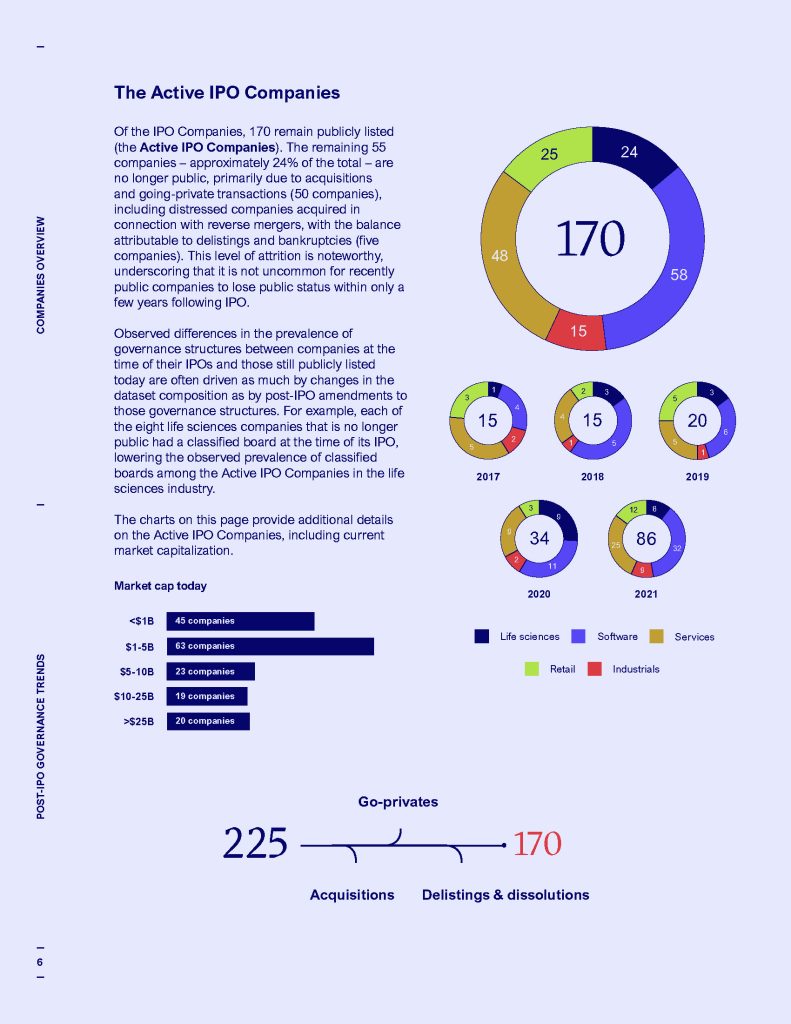

Please provide the following information and press submit to access the report.